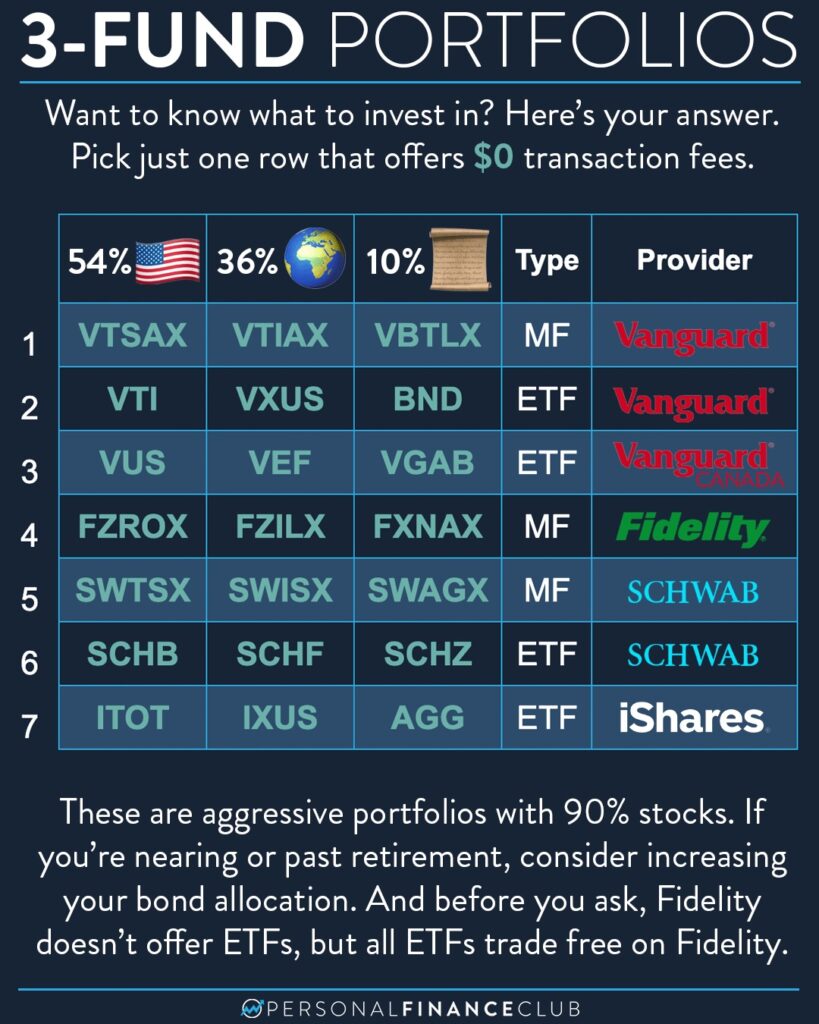

Last week I posted how my investments went up $451K in 2025 ($380K in share price plus $70K paid out in dividends). I got this question a lot, “What are you investing in?!” Here’s your answer! A simple three-fund portfolio gives you direct access to the growth and innovation of the world’s companies at a tiny cost. The annual expense ratios on these funds are all less than 0.1%, which is tiny.

It’s really tempting in investing to introduce complexity in an attempt to chase better returns. But the more I learn, the more I invest, the more studies I read, the more certain I am of the opposite. The SIMPLER your portfolio, the more likely you are to have better returns. You just need the confidence and discipline to keep investing early and often, and stay the course!

I’ll say it again here, since people always ask: FIDELITY DOESN’T HAVE ITS OWN LINE OF BROAD MARKET INDEX ETFs SUITABLE FOR A THREE FUND PORTFOLIO. Why? Because they struck a deal with iShares back in the day to offer free trades on iShares ETFs. That deal is since moot because now ALL ETFs trade free on Fidelity (and pretty much every US brokerage), but Fidelity still hasn’t released their own brand.

ALSO! HUGE ANNOUNCEMENT ALERT!!! We’re hosting our FIRST EVER FIRE CRASH COURSE COHORT at the end of January. This will be a six-week program where we give you the fastest path to an early retirement plan. Net worth, investing, taxes, estate planning, and more. We’ll show you exactly how to do it. It’s going to be limited to 500 students max. Sign ups start on January 19th. Stay tuned for more details!

As always, reminding you to build wealth by following the two PFC rules: 1.) Live below your means and 2.) Invest early and often.

-Jeremy