The commission, chaired by Arvind Panagariya also decided to add states’ contribution to GDP among its horizontal devolution criteria, and suggested stricter fiscal discipline for states.

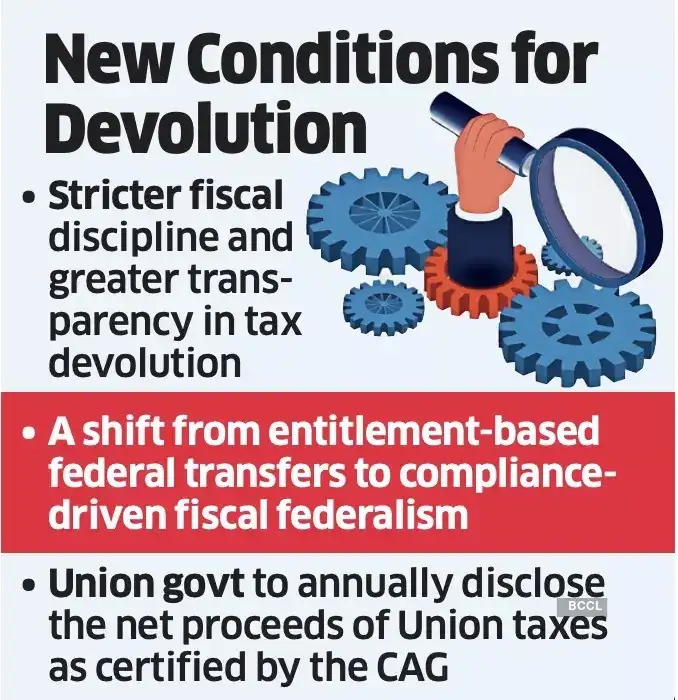

It also called for annual disclosure of net proceeds of Union taxes as certified by the Comptroller and Auditor General to bring greater transparency in tax devolution.

States are also required to disclose their off-budget borrowings.

This marks a shift from entitlement-based federal transfers to compliance-driven fiscal federalism.

The commission enhanced disaster grants. It enforced stricter timelines for fund transfers to local governments, any failure in which would attract higher penalties.

Finance minister Nirmala Sitharaman Sunday submitted the report by the Finance Commission along with an explanatory memorandum detailing action taken on its key recommendations.

The Centre has accepted the recommendation on both vertical and horizontal devolution and said it will examine the proposal of doing away with revenue deficit grants.

“For the first time centre removed this grant,” Himachal Pradesh chief minister Sukhvinder Singh Sukhu said, adding that this omission overlooks structural fiscal handicaps for hill states like Himachal Pradesh vulnerable to natural disasters.

For horizontal devolution, the commission will give 15.5% weightage to population based on 2011 census, 10% to demographic performance, 10% each to area and forest cover, 42.5% on per-capita income distance and rest on states’ contribution to GDP, with the centre accepting the recommendation.

Of total grants of Rs 7.91 lakh crore grants to rural and urban local bodies 60% earmarked for rural local bodies and 40% for urban local bodies, with 20% grant to be performance-linked and half of the basic grant tied to sanitation, solid waste management and water management.

Performance grants will be further divided between local body-level outcomes and state-level reforms.

States will have to meet conditions like timely constitution of local bodies and State Finance Commissions, online disclosure of audited accounts, and submission of action-taken reports to state legislatures to access grant.

The commission proposed an urbanisation premium of ₹10,000 crore to incentivise the merger of peri-urban villages into larger urban local bodies, alongside a ₹56,100-crore special infrastructure window for comprehensive wastewater management in select urban growth centres.

States will be required to transfer funds to local bodies within 10 working days of receipt from the centre, failing which interest will be payable.

For disaster management, the commission has recommended a combined ₹2.04 lakh crore corpus for State Disaster Response and Mitigation Funds over five years, with an 80:20 split between response and mitigation and capping the share of centre to ₹1.56 lakh crore.

The commission has also proposed separate allocations of ₹79,406 crore for the National Disaster Response and Mitigation Funds with a condition that from 2027-28 onwards, states will need to fully upload and validate data on the National Disaster Management Information System portal to access grants.

The commission has called for strict enforcement of a 3% gross state domestic produce (GSDP) cap on states’ fiscal deficits, discontinuation of off-budget borrowings, amendments to state fiscal responsibility laws with a roadmap for centre to bring down its fiscal deficit down to 3.5% of GDP by the end of the award period.

The centre has accepted the borrowing cap for states in principle, adding that other fiscal recommendations will be examined separately.