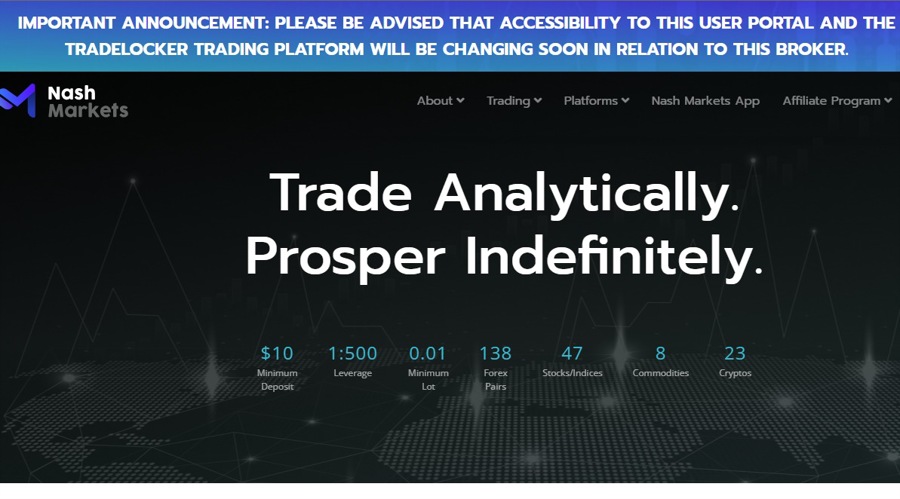

At least three CFD offshore brokers – Kot4X, SageFX, and Nash Markets – appear to be shutting down soon. “Please be advised that accessibility to this User Portal and the TradeLocker Trading Platform will be changing soon in relation to this Broker,” the notice on all three websites states.

A Vague Message, but Intention Is Clear

Although the three brokers did not explicitly say they are shutting down operations, they appear to be dropping TradeLocker as their trading platform.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Nash Markets and SageFX will stop their users from opening new positions from 19 September and will automatically close all open positions on 29 September. For Kot4X, these deadlines are 21 September and 1 October, respectively.

All three brokers also asked traders on their platforms to withdraw all funds from their accounts before the respective second deadline. “Failure to act could delay your ability to access your funds or manage your account,” all three wrote.

Read more: Around 20% FCA-Regulated CFD Brokers Are Inactive

All three brokers are also using the same customer support solution.

Nash Markets and Kot4X are registered in St Vincent and the Grenadines, while SageFX is registered in the Marshall Islands.

Another broker, OspreyFX, already ceased operations in June, and now displays a notice on its website stating that it was “ceasing its operations and undergoing the termination of its relationships with its technology providers.”

A notice on the OspreyFX website

However, several other brokers are still offering CFDs trading services using the TradeLocker trading platform.

Brokers Are Consolidating Their Markets

FinanceMagnates.com recently reported that multiple established brands also shut services in certain geographies. Japan-based Hirose Financial “permanently closed” onboarding new retail traders under its United Kingdom- and Labuan-regulated entities. However, the broker’s Japanese operations appear to still be running.

AETOS is another broker to first close its UK operations and then its offshore business. However, it remains operational in Australia.

At least three CFD offshore brokers – Kot4X, SageFX, and Nash Markets – appear to be shutting down soon. “Please be advised that accessibility to this User Portal and the TradeLocker Trading Platform will be changing soon in relation to this Broker,” the notice on all three websites states.

A Vague Message, but Intention Is Clear

Although the three brokers did not explicitly say they are shutting down operations, they appear to be dropping TradeLocker as their trading platform.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

Nash Markets and SageFX will stop their users from opening new positions from 19 September and will automatically close all open positions on 29 September. For Kot4X, these deadlines are 21 September and 1 October, respectively.

All three brokers also asked traders on their platforms to withdraw all funds from their accounts before the respective second deadline. “Failure to act could delay your ability to access your funds or manage your account,” all three wrote.

Read more: Around 20% FCA-Regulated CFD Brokers Are Inactive

All three brokers are also using the same customer support solution.

Nash Markets and Kot4X are registered in St Vincent and the Grenadines, while SageFX is registered in the Marshall Islands.

Another broker, OspreyFX, already ceased operations in June, and now displays a notice on its website stating that it was “ceasing its operations and undergoing the termination of its relationships with its technology providers.”

A notice on the OspreyFX website

However, several other brokers are still offering CFDs trading services using the TradeLocker trading platform.

Brokers Are Consolidating Their Markets

FinanceMagnates.com recently reported that multiple established brands also shut services in certain geographies. Japan-based Hirose Financial “permanently closed” onboarding new retail traders under its United Kingdom- and Labuan-regulated entities. However, the broker’s Japanese operations appear to still be running.

AETOS is another broker to first close its UK operations and then its offshore business. However, it remains operational in Australia.