Automotive stocks are in focus after the news on proposed reduction of GST rates on vehicles. Stocks of component suppliers are good proxies to ride the likely revival in demand. One such stock with a promising future is Coimbatore-based Pricol, a market leader in instrument clusters (panel that houses vital vehicle information such as speed, fuel level, etc.).

Fundamentally, the company is well sorted with a debt-free balance sheet. It has posted decent growth in FY25 and in Q1 FY26, outpacing a slowing auto market. Business-wise, it is riding the premiumisation wave in instrument clusters (ICs) – from basic analog ones to more sophisticated LCD and TFT units, that have modern technology such as Bluetooth connectivity, navigation assist and over-the-air updates. TFT displays offer better image sharpness and colour accuracy and thus offer superior readability to LCD units. Beside ICs, Pricol has products in its portfolio, which are largely powertrain agnostic, while also offering EV-specific products such as BMS (battery management system) and cell holders. Business is largely domestic, with little exposure to the US market.

In FY25, Pricol acquired the injection-moulded plastic components business from Sundaram Auto Components (SACL). This business is housed in Pricol’s subsidiary Pricol Precision Products. With new clients expected to be on-boarded, the vertical has potential to scale up further.

After scaling an all-time high of ₹599 in December last year, the stock is now trading 23 per cent below its all-time high. In fact, the stock has been consolidating in a range since recovering from its 52-week low in April. At about 25x its likely earnings in FY26, the stock now trades at a reasonable valuation, given its growth prospects. Long-term investors can accumulate the stock. Given it is a small-cap and that it operates in the auto industry, which is currently in a cyclical slowdown, investors can accumulate small quantities of the stock in intervals, rather than in one go.

What it does

Pricol operates with three verticals: Driver information and connected vehicle systems; Actuation, control and fluid management systems; and Precision products. The first vertical houses ICs (LCD & TFT), fuel level sensors, telematics solutions and BMS for EVs (in testing currently). The second vertical comprises products such as disc brakes and fluid pumps such as fuel pumps and coolant pumps. The third vertical consists of the acquired business mentioned earlier and supplies products such as body panels, fuel tanks, shrouds and seat bases among others. A keen look into the product portfolio reveals that most products are powertrain agnostic.

Pricol supplies to almost all marquee OEMs in the domestic market across two-wheelers (2Ws), three-wheelers (3Ws), passenger vehicles (PVs) and commercial vehicles (CVs). It also has international clientele, but exports make only 7-8 per cent of the revenue. The end use-wise revenue break-up roughly stands as: 2Ws & 3Ws – 65 per cent, PVs – 10 per cent, CVs – 15 per cent and off-road vehicles – 10 per cent. TVS is a key client (revenue share not disclosed), which has helped drive the company’s growth in recent quarters, as it was among the few OEMs expanding in an otherwise slowing auto market.

Under the hood

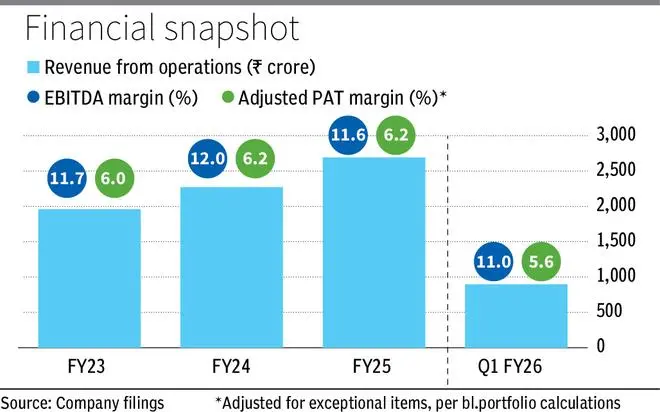

After sustaining losses from disposal of loss-making foreign subsidiaries and battling weak demand during Covid in fiscals FY18-20, Pricol’s earnings were back in the black in FY21. Performance from then has been good, riding the post-pandemic demand rebound, with revenue, EBITDA and PAT CAGRs of 20 per cent, 20 per cent and 48 per cent in FY22-25. Remarkably, margins have been steady – both at gross and EBITDA levels.

Pricol is efficient in converting earnings to cash. Its cash flow from operations to EBITDA ratio has been consistently above 1. Return on capital employed has been in a range of 20-22 per cent in the last three years. Besides, the company is practically debt-free.

The industry has been in a slowdown in FY25, which continued into Q1 FY26. Sale of 2Ws by OEMs grew just 1 per cent in Q1, partly due to the shortage of rare-earth magnets. However, Pricol’s revenue and PAT grew 19 per cent each in FY25; 44 per cent and 9 per cent in Q1 FY26. The acquired business’ financials were included in the consolidated results from February 2025, explaining the 44 per cent revenue jump in Q1 FY26. Higher depreciation, impact of the acquisition and unfavourable currency movements as regards imported parts explain the lower 9 per cent earnings growth in the recent quarter. EBITDA margin stood at 11 per cent, down from 13 per cent in Q1 FY25, although only slightly lower than FY25’s margin at 11.6 per cent. Even when looked excluding the acquisition, revenue growth was a decent 12 per cent.

Though domestic market was in a slowdown, most OEMs had good export demand. This combined with the TVS factor partly explains the resilient performance.

Looking through the windshield

Going ahead, the outlook looks promising for Pricol, with a clutch of tailwinds. The company is a beneficiary of the premiumisation trend in ICs, with the penetration of LCD and TFT displays increasing. TFT displays now have just an 8-per cent market share.

The acquired precision products vertical, too, can scale up. Under SACL, the division largely served TVS. Now that the business has been taken over, Pricol could onboard new clients. Margin-wise, this business is currently EBITDA-dilutive with its EBITDA margin in Q1 FY26 at 7 per cent. However, with economies of scale and cost efficiencies, this could expand. The vertical made 23 per cent of consolidated revenue in Q1 FY26.

The disc brake business is fairly new and is currently serving a few EV startups. Mass production is expected from Q4 of this fiscal. Further, ABS is likely to be mandated for all 2Ws with engine capacity of below 125 cc. This is positive for the nascent business because ABS needs disc brakes to work – implying 2Ws that are equipped with drum brakes now will have to be upgraded to disc brakes.

New product launches in Q1 FY26 find application in some of the best-selling models in the market such as Bajaj’s Chetak, RE and Maxima 3Ws, TVS’ iQube, Force’s Traveller and Tata’s Altroz. Pricol has also signed a technology licensing agreement with Domino S.r.l, Italy, to supply handlebar-mounted controls such as throttle and switchgear to Indian and South-East Asian OEMs. Revenue realisation is still a few quarters away though. Above all, a probable revival in the auto market by virtue of GST rate cuts is an additional tailwind.

Published on August 30, 2025