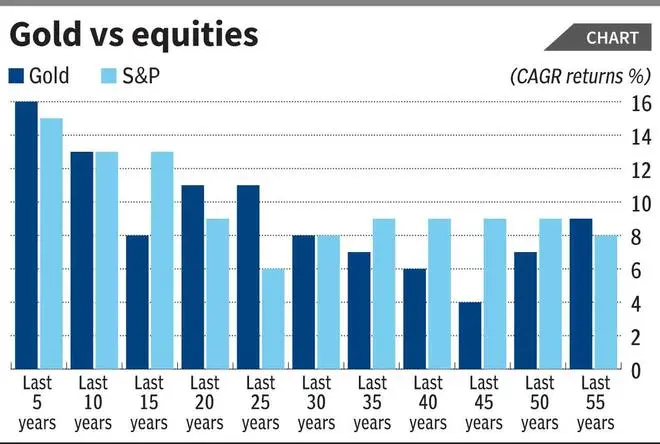

Gold has consistently come on top or on par with equities.

Billions of dollars are spent by global investors year after year in hedge fund performance fees, sell-side equity research and brokerage costs to gain access to sophisticated fund management or stock recommendations that spectacularly under-perform gold. Overall, gold has consistently come on top or on par with equities (see chart 1) over the last 30 years. Further, when one considers risk-adjusted returns, given much higher volatility of equities, it’s not just outperformance by gold, but a trouncing.

What’s driving it?

Richard Nixon may have junked the gold standard and ushered in a new global monetary order of fiat currency, but that cannot alter the fundamentals of economics. Too much money chasing too few goods triggers inflation that debases fiat currency. Geopolitical uncertainties unnerve investors as risks of political instability can erode trust in a currency. Central bankers and governments failing to convince the public that they are serious in their intention to keep inflation under control, would make them believe currency will continue to get debased. Gold thrives in such an environment, and all the above factors are at play today.

In the US inflation is on an uptrend, geopolitical uncertainties have increased and tariff wars have only added to that. Further very high fiscal deficit in the US (and in a few other developed economies as well) combined with the US Fed failing in its inflation mandate for 4 years non-stop and yet cutting rates, mean public confidence that inflation will be tamed is eroding.

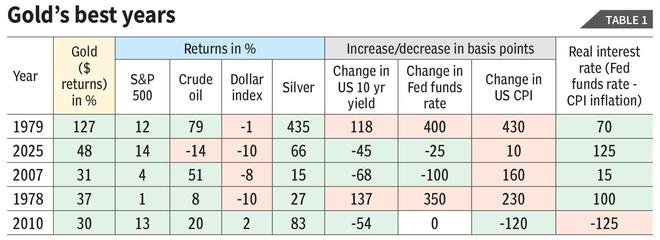

All these factors have combined to drive the yellow metal’s 47 per cent upsurge this year, its best ever since the 127 per cent returns in 1979.

But this is now history. What is the upsurge signalling for investors? After all, equities and gold and bonds have all moved up in tandem in some of the years in the past, hence just because gold is surging does not automatically imply there are risks to other assets.

To a get a better perspective, we looked at the five best years for gold in the last 50 years and how different variables played out in those years.

Bad for $ index

One obvious factor is that the best years for gold are bad for the dollar index (DXY); after all, gold performance is measured in USD here. However, it is not something that plays out every time.

In 2010, gold surged 30 per cent, but the DXY, too, was up marginally. This was a time when inflation was the last thing on anyone’s mind as the global economy was reeling from pangs of the Great Recession and the Euro Zone debt crisis. Gold, USD, any thing that was safe haven was above par for investors. Similarly in gold’s best year ever, 1979, the DXY was only marginally down. This was the year of the Iran revolution, a perfect storm of a geopolitical crisis and high oil prices driving inflation.

Broadly across gold’s best years, equities, crude oil, silver have all given positive returns. Another factor is the US consumer price inflation was on an uptrend in most of the years. Hence, while real interest rates were marginally positive (except in 2010), public confidence that inflation will be tamed was lacking.

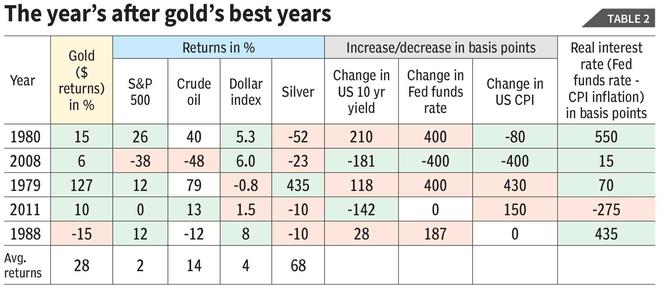

Now what is more important for investors here? What do gold and other assets do the next year (see table 3). The trend continues! In four out of five instances, the shine in the metal only increased. Investors would have been better off choosing gold after its best years rather than choosing equities. The average returns of the ‘next five years’ period is 28 per cent for gold versus a mere 2 per cent for S&P 500.

This should serve as a note of caution for equity investors. Investors (including those in India) would do well to keep an eye on sky-high equity valuations, the uptrend in the US inflation, and the sparring between Trump and the Fed, which is further eroding public confidence in inflation control. This should serve as a note of caution for equity investors. Of course, some would like to believe this time is different — there is this AI boom and predictions of a US recession continue to get skirted. But then investors (including those in India would do well to keep an eye on — sky high equity valuations, uptrend in US inflation, the spar between Trump and the Fed further eroding public confidence with regard to inflation.

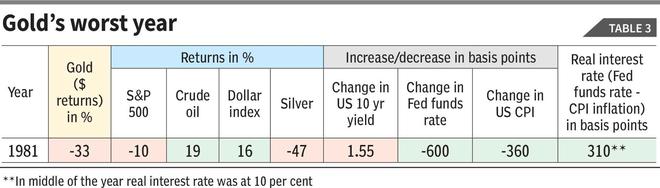

What should gold investors worry about? Look to 1981 — its worst year when it fell 33 per cent. That was the year of the Volcker shock. Paul Volcker, the Fed Chairman then, increased fed funds rate to 20 per cent in the middle of the year with real interest rates reaching a staggering 10 per cent, and brought down inflation expectations. The DXY surged 16 per cent that year.

Published on October 4, 2025