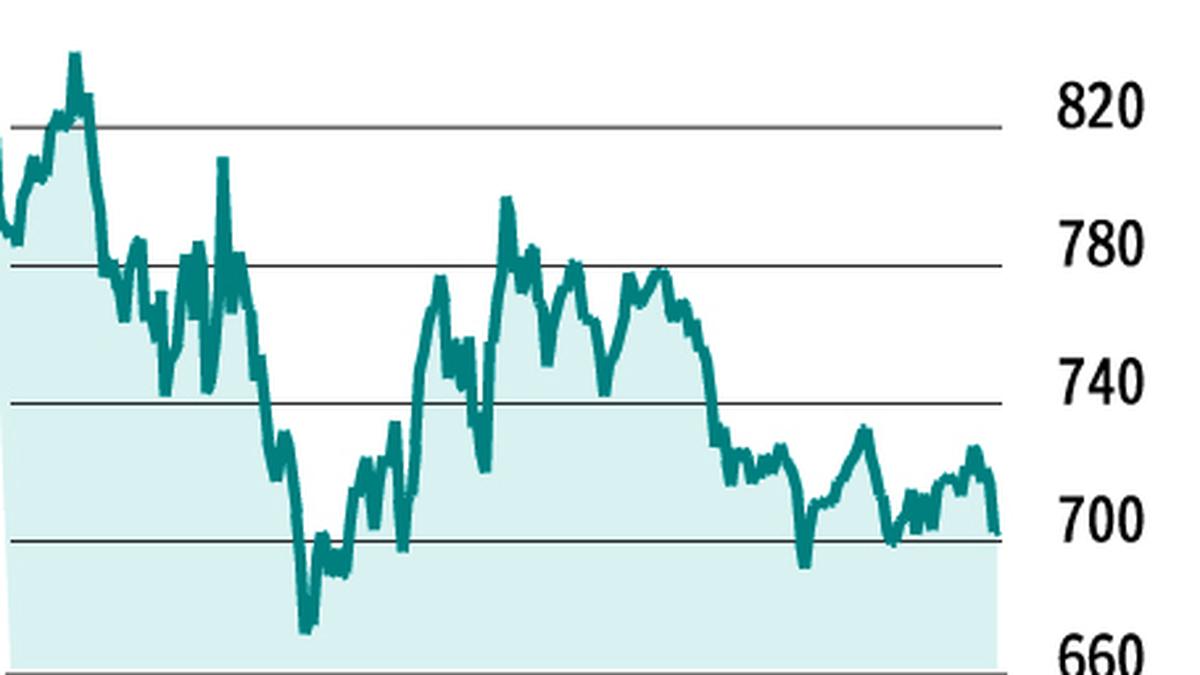

The stock of Indian Railway Catering and Tourism Corporation (IRCTC) is ruling at a crucial level. Immediate support is at ₹691 and a major one at ₹670. Resistance is at ₹721 and the major one is at ₹756. In the short-term, we expect IRCTC to move in a narrow range but with positive bias.

IRCTC will declare its Q2 results on November 12.

F&O pointers: IRCTC November Futures closed at ₹701.40 against the spot price of ₹704.15. The contract has been in backwardation, as its board on November 12 will also consider an interim dividend. The contract witnessed a steady build up in open interests, from 14.54 lakh shares on October 7 to 1.47 crore shares on November 9. Option trading signals that IRCTC could move in the ₹700-800 range.

Strategy: We advise traders to consider buying 710-call of IRCTC that closed with a premium of ₹10.95. As the market lot is 875, the strategy would cost ₹9,581.25, which would be the maximum loss one can expect. The maximum loss will happen if IRCTC sustains below ₹710.

On the other hand, profit potentials are high if IRCTC speeds up sharply during this series. We advise traders to aim for a premium of ₹17.5-18. Initial stop-loss can be placed at ₹6.5 that can be shifted to ₹10 if IRCTC opens on a positive note and the premium moves up to ₹12.5. Handle the stop-loss deftly to protect profit or cut losses.

Due to the results, the stock may remain volatile and hence this strategy is only for those who can understand risk. Others can stay way. Similarly, traders can stay away if the stock opens sharply higher at ₹710-712.

Follow-up: DLF opened on expected lines, and would have hit the target. Those who missed out can aim for the bounce back to cut losses.

Published on November 8, 2025