00:00 Speaker A

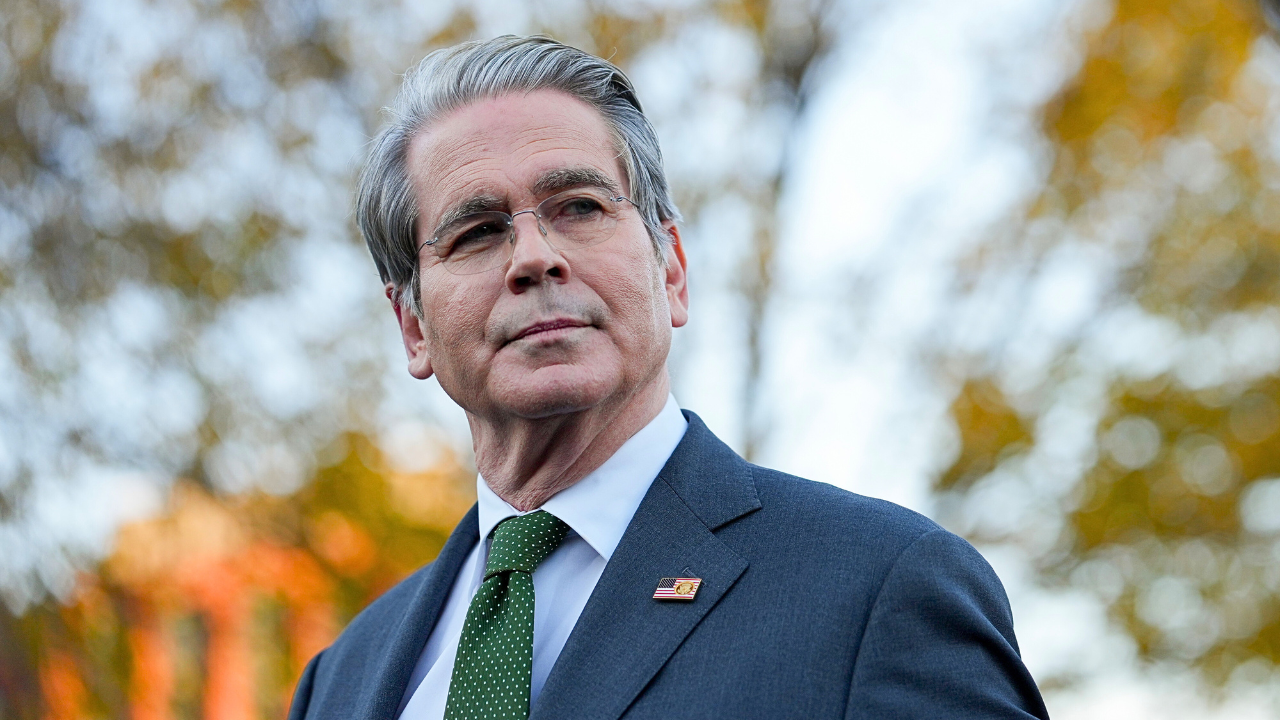

My next guest says the AI bubble talk is ridiculous. Joining me now Brian Belski, Humulus Investment Strategy CEO and chief investment officer.

00:09 Brian Belski

Who wrote that? Ridiculous. Oh, that was me.

00:11 Speaker A

Oh, it was you, wasn’t it? So, okay, what

00:13 Brian Belski

Oh my gosh. Nicole, thank you so much for having me.

00:14 Speaker A

Yeah, it’s good to have you. Why is it ridiculous? The AI bubble talk?

00:18 Brian Belski

Just because prices go up doesn’t mean it’s a bubble. And I think bubble is one of the most overused words in financial industry.

00:26 Speaker A

Okay, so what so what is a bubble then? What would define a bubble?

00:30 Brian Belski

A bubble means that there’s froth, right, everywhere. Uh and to from our lens, um you can’t get a bubble until everyone’s making money. And you’re going to say, everybody made money last year, really? No. Well you

00:46 Speaker A

I mean, the dotcom bubble, everyone wasn’t making money.

00:49 Brian Belski

Uh well, if you look at if if you go back

00:52 Speaker A

Or when you say everyone’s making money, do you mean people in the market or do you mean the companies?

00:55 Brian Belski

I’m talking companies, but more importantly, quote-unquote, the man. And what I mean by that is if you go back and look at at the 1990s and the average private wealth account was 90% stocks and a very high percentage of those stocks were tech stocks, okay? So private wealth got locked out or just crushed when when the dot com bubble actually did burst. But so did institutions. It changed the way that we were running money because institutions started to doubt analysts and bankers and that’s the advent, not the ad, but really the I would say the focus on quant investing and modeling, okay? Let’s go back. Who’s the man? The man are investment banks. If you think about what’s happening in in the AI world right now, it’s very select on where the deals are getting done. Back in the late 90s, you had these goofy quote-unquote deals where companies were buying other companies for stock, stock that didn’t have any value, right? So the investment banks were getting rich, the brokers were getting rich, the companies were getting rich. When everybody’s getting rich, that’s a that’s a bubble. Oh, by the way, happened in 2007, 2008 in financial services as well. The banks were making money, the brokerage dealers making money, the mortgage bankers were making money. And so at the end of the day, we need to see a lot more quote-unquote froth and AI and and I think what’s making this not a bubble as well is a theme that I think is going to take place and manifest itself even more so in 2026 and it’s this theme of dispersion. A lot of people start talking about dispersion, but dispersion is about stock picking. Just look at the Magnificent 7. I’m going to go, I’m going to be brash and make a prediction. I think the Magnificent 7 a year from now, those seven companies will be different companies. We’re going to have we’re going to have

02:53 Speaker A

Well, we should they already are different companies. I know, but we’re

02:56 Brian Belski

going to have even more so and I

02:57 Speaker A

We we we shouldn’t even be calling them. I mean we’ve been we should get rid of Magnificent 7 already. They have already dispersed if you will.

03:04 Brian Belski

They have. And if you just look at the last month or so. Look at the last month in terms of fundamental realities of Meta versus Google, right?

03:13 Speaker A

And Tesla is like over here.

03:14 Brian Belski

And Tesla yeah, Tesla Tesla’s Tesla’s not even a technology company. It’s a consumer discretionary company. So then you got to go back is why consumer discretionary been doing so well, but relatively, if you take it under if you look under the hood, you got a lot of companies into consumer discretion not doing well. So because it’s the the sector is skewed by Amazon and Tesla. Someone say Amazon’s futures is about AWS, not the retail business. So I mean this is all about stock picking fundamental analysis, but at the end of the day, I think next year is going to be about picking stocks within sectors with high standard deviations of returns and and fundamentals, meaning you’re going to have to pick stocks, not the sector and not broader index ETFs.

03:57 Speaker A

Okay. So what stock you pick or what screen you apply to figure out what’s going to do the best?

04:02 Brian Belski

So it’s a great question. It’s a bit of a trap because we don’t run money on screens. We run money on fundamentals. So what we do for years now, I’m not going to tell you how long I’ve been doing it, but you know how long. So running money for over 20 but in the business for 36 is that if you if you look at the bottoms up and marry the top down. Now I’m not talking about economic variables or the Fed today. I’m talking about top down broader.

04:41 Speaker A

Okay, I’m going to I’m going to pause you for just one second. For for people who are not steeped in finance speak, top down means you look at the macroeconomic environment, you look at what the Fed is doing and you make investment decisions. Bottoms up means you look at company by company, what their earnings look like and make decisions that way. Is that a fair way to describe the two?

05:01 Brian Belski

Correct. But on the top downside, the way we look at it is we look at broader models that encompass the entire market, okay? From a fundamental perspective, looking at valuation, earnings growth, operating performance and performance. What’s operating performance? The return structures. Uh return on equity, return on assets, return on invested capital of the market sectors and industries. We have these models and then we take a look at why do I want to buy Google in communication services in the S&P 500 relative to why do I want to buy Reddit in the communication services uh sector in the S&P 1000. So we do that type of work and balance that out. I think you’re going to want to be more balanced on the bottoms up. You’re still going to look at where the valuations are. and obviously macro data is macro data, economic data, ISM, PPI is is all lagged, but you have to incorporate that from a peripheral vision. but I think it’s going to be bottoms up stock picking. You can run a screen in terms of how this stock is relative value or earnings growth compared to the market. But you’re not going to run a multi-factor, I don’t believe a multi-factor quant model because sometimes with that, a lot of times with that, it’s analysis paralysis and it’s too much information. What’s happened in Wall Street, going back to the very beginning about the bubble thing in in in 99 2000, Wall Street lost credibility in terms of analyst and bankers because it was everything was going to go up, you throw a dart, right? So that was the advent and really focus on quant. And what happened was people became too formulaic because they were so afraid to be wrong, they didn’t want to be right. It’s now time to believe in America and to believe in companies again and believe how awesome they are. The United States of America has the best companies in the world. We’ve proved it over the last 10 or 12 years. We still believe that we’re in the midst of a 25-year secular bull market that started in 2009 and has another 10 years to go. We believe the next 10 years are going to be very different than the last 10 years though.

07:11 Speaker A

Okay. Okay, so just one quick pause. So the you think that the um international outperformance this year was an aberration or a blip or just a temporary disconnect before a resumption of US stocks performing better on a relative basis?

07:22 Brian Belski

We believe, well, first of all, those stocks were cheap for a reason because fundamentally they’ve underperformed for a long time and uh they came back pretty strongly because most of that was driven through fear and loathing in the United States what was happening with the policies of the president of the United States and what’s going on with tariffs. So so money left and they chased it elsewhere. But if you look going forward, you get what you pay for, right? We get to pay for in the United States in terms of the the index itself and the diversified nature of of our economy, world’s largest economy and the strength of that economy. Our economy strengthened in the last 10 years relative to China has weakened in the last 10 years. Just to think about that. In terms of the other international markets, fantastic. You’re going to have these types of near term one or two year all performance, but from a secular perspective, it’s still best to be in the United States. So I always live by the old adage of of Warren Buffett, don’t buy anything unless you can reach out and touch it. I want to be able to understand and see the companies that I invest in relative to looking at something international that doesn’t have the wherewithal and consistency and fundamentals that the United States companies have.

08:37 Speaker A

Okay. So to come back to what you said, if you look a year from now or a decade from now, what are going to be the winners? And how do you figure that out?

08:44 Brian Belski

Well we figure that out by looking at good old fashioned things like balance sheet consistency, cash flow consistency, earnings consistency. What’s the addressable market of that company? What’s their proven track record of managing that business. Now, for instance, what Google did this year, people, I I don’t think people are talking about this enough. They brought back former CEOs and their founders to kind of reposition the company. They made strategic alliances with with Apple, right? Keep your friends close and your enemies closer. Um I think the uh the company was uh sold off too soon in April when everybody decided that Chat GBT was going to take over the world and we’re we’re going to ever search again. To me, that was ridiculous. So that provided an opportunity. And then you’ve take a look at the company itself with respect to what’s going on with with AI, but also it’s YouTube business. It’s YouTube business is bigger than Netflix. And one of my favorite sectors for the last decade has been communication services because of the cash, content and consolidation. That’s been our our our theme for 10 years. So we think that’s going to continue. So Google we think will be a major winner going forward. We think Microsoft will continue to be a major winner going forward because the company has demonstrated from a from a cash flow and earnings perspective that it can get through this, but also it has the best technology, the best management team in terms of where they’re going and with respect to having a track record in this. Amazon’s another one because of their other business ventures, but also what they’ve done with AWS. Apple, Apple has more cash than the balance sheet than several international company or countries that people want to buy.

10:52 Speaker A

And you’re not worried about some of the management changes and shakeups they’ve had there recently in terms of the AI chief leaving and some of those changes?

11:03 Brian Belski

I’m not because at the end of the day, that’s what’s really going to be driving things going forward in terms of the overall management, they’ll find the right people uh to take care of that stuff. And it’s not all about AI. some of their other late legacy businesses as well, they’re going to do very well.

11:15 Speaker A

So that’s the magnificent four then for you now. Or do you not like I mean how do you feel about Nvidia?

11:21 Brian Belski

We’re owners of Nvidia. We’ve owned Nvidia uh in terms of our assets under advisement that we ran in our prior place that we’ll continue to look at going forward uh since 2017, 2018. It’s a stock that um I also owned when it was a midcap name in the in the mid 2000. so very familiar with Jensen as a manager, as a person, as a man in terms of how he’s run that company. Amazing as a visionary. So at 8% or 78% of the S&P exceedingly difficult to be overweight that name. So we’ve been and on record in our published reports, we’ve been more neutral to underweight just because it’s difficult. but I think we can make up our our tracking error in being overweight some of those other names and then also overlaying believing in in Oracle and what’s happening there longer term and believing in in um names like Palo Alto. Um and so that’s where we’ve been. I think that’s where we’re going to continue to be.

12:20 Speaker A

It’s so nice to be able to talk specific stocks with you. Yes. This is a change. Thanks so much Brian for coming in. I appreciate it.

12:22 Brian Belski

Isn’t it great? It’s fun.

12:26 Brian Belski

Thanks so much for having me.