This may be your last chance to step into a name you know is 100% Buffett-approved. Just know that the Oracle of Omaha’s approval alone still isn’t a guarantee of success.

With Warren Buffett’s 55-year tenure as Berkshire Hathaway‘s (BRK.A +0.09%) (BRK.B +0.15%) CEO and chief stock-picker set to come to a close at the end of this year, plenty of investors are understandably disappointed. After all, they’ll no longer be able to copy the occasional pick from the Oracle of Omaha’s market-beating portfolio. If you’re looking for an idea you know for sure is a Buffett-approved pick, you’d better act soon before these stock-selection duties are passed on to his successor.

Still, it’s not like Buffett’s been perfect. Even he acknowledges he makes the occasional investing misstep.

With that as the backdrop, here’s a closer look at a couple of current Berkshire holdings that would likely work for your portfolio as well, and one name Warren Buffett recently bought that you might not want to … at least not yet, and maybe never.

Image source: Motley Fool.

A stock to buy: American Express

Given how infrequently it’s highlighted as a Buffett pick, many investors are surprised to learn that credit card powerhouse American Express (AXP +0.24%) is Berkshire Hathaway’s second-biggest stock trade; the position is worth nearly $58 billion and accounts for more than 18% of the conglomerate’s portfolio. Even more telling is that it’s also one of Berkshire’s longest-held undisturbed holdings. Whereas Buffett’s been steadily paring back supersized stakes in Apple and Bank of America, Berkshire’s 151.6 million shares in American Express are the same number of shares it has owned since first buying it back in 2006. This speaks volumes about long-term confidence in the company.

That being said, it’s not difficult to understand why Buffett is such a big fan.

Today’s Change

(0.24%) $0.92

Current Price

$383.11

Key Data Points

Market Cap

$264B

Day’s Range

$380.74 – $384.73

52wk Range

$220.43 – $387.49

Volume

817K

Avg Vol

2.5M

Gross Margin

61.04%

Dividend Yield

0.82%

While not as big as Visa or Mastercard, nor growing as quickly as either one right now, AmEx caters to more affluent consumers who aren’t really rattled by economic headwinds. The company’s third-quarter revenue growth accelerated to a year-over-year pace of nearly 11%, coming in at a little over $18.4 billion versus analysts’ estimates of only $18.05 billion. Then, in early December, American Express reported a 9% year-over-year increase in consumer spending during the Thanksgiving holiday weekend, with its wealthiest cardholders pumping up their spending even more, proving the card company’s resilience.

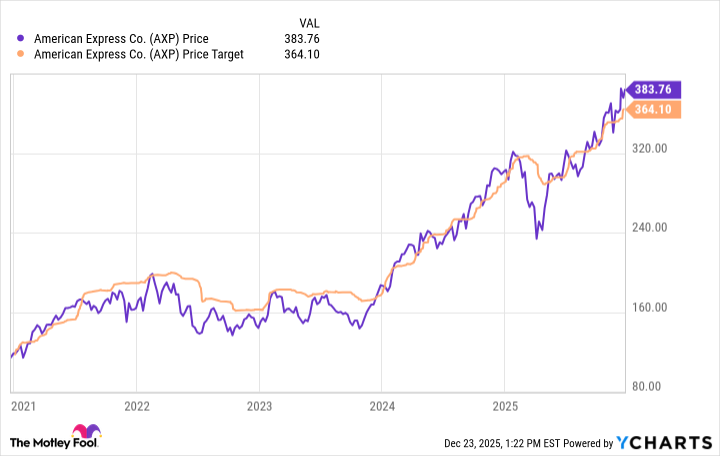

Do you know that AXP shares are one of Wall Street’s few stocks presently trading above their consensus target price, prompting some interested investors to balk. That’s why it wouldn’t be completely crazy to see if a better price becomes available in the near future.

Just don’t let discipline turn into stubbornness. This is one of those cases where a ticker’s price leads its consensus target just as much as it’s led by it.

Data by YCharts.

In other words, don’t sweat the ho-hum consensus too much. Instead, just focus on the consistent quality of American Express’s business, as Buffett does. The premium you’re paying for it eventually ends up paying for itself.

A stock to buy: Alphabet

Just a few years ago, the idea of Berkshire Hathaway taking on a position in Google parent Alphabet (GOOG 0.07%)(GOOGL 0.12%) was unthinkable. Buffett’s simply never been a big fan of technology stocks, saying he didn’t understand them well enough to assess them.

Something’s clearly changed in the meantime, though. While Berkshire’s stake in Google’s parent is a modest 17.8 million shares worth only $5.6 billion, the fact that Buffett’s allowed any-sized piece of this tech outfit into the portfolio is actually a pretty big deal … even if it was likely mostly encouraged by one of his stock-picking lieutenants.

Today’s Change

(-0.12%) $-0.39

Current Price

$313.96

Key Data Points

Market Cap

$3.8T

Day’s Range

$311.95 – $314.97

52wk Range

$140.53 – $328.83

Volume

347K

Avg Vol

36M

Gross Margin

59.18%

Dividend Yield

0.26%

The thing is, this pick actually makes good sense even if it’s not quite the Oracle of Omaha’s typical fare. Google’s share of the global search engine market is holding firm at 90%, according to Statcounter, while its Android operating system is installed on more than 70% of the world’s mobile devices. And, while Synergy Research Group reports that Google’s piece of the worldwide cloud computing market is a fairly modest 13% versus Amazon‘s 29% and Microsoft‘s 20%, Google’s share is growing faster than that of its two top rivals, with its revenue improving 33% year over year last quarter.

It’s still not always an easy business to understand, particularly for anyone who isn’t digitally native (or at least familiar with consumer-facing technologies due to regular usage of them). It’s not difficult to understand, however, that Alphabet is investment-worthy not just because it offers a handful of marketable products, but because this company was built from the ground up to remain ready, willing, and able to adapt to an ever-changing technological landscape.

A stock to avoid: UnitedHealth Group

Finally, while the superficial logic of the pick makes enough sense, Berkshire’s recent addition of health insurer UnitedHealth Group (UNH +0.98%) to its stock portfolio may not be one you want to follow.

The chief motivation here is the discounted price on shares of a seemingly stable company. From April’s share price peak near $605 to August’s trough of less than $235 — more than a 60% setback — stemming from combination of unexpectedly high reimbursement costs, a DOJ investigation into its Medicare billing practices, and the surprising resignation of UnitedHealth’s CEO Andrew Witty in May, it felt like all the bad news that could be baked in had been baked in. And, perhaps it was.

Today’s Change

(0.98%) $3.19

Current Price

$327.99

Key Data Points

Market Cap

$297B

Day’s Range

$324.23 – $328.99

52wk Range

$234.60 – $606.36

Volume

82K

Avg Vol

7.9M

Dividend Yield

2.66%

There’s a bigger secular headwind blowing against the entire health insurance industry, however, that’s not going to be overcome with new leadership or tighter control of the company’s operation. That’s a nationwide effort to keep consumers’ healthcare costs contained. The White House recently inked deals with nine different pharmaceutical companies to lower Americans’ drug prices, for instance, and unless something changes, the impending end to subsidies called for by the Affordable Care Act could ultimately undermine demand for UnitedHealth’s ACA coverage plans. Meanwhile, the Department of Justice’s scrutiny of UnitedHealth’s Medicare billing is a microcosm of the frustration with the entire healthcare industry’s ever-growing lack of regulatory accountability. All of it works against the company.

Sure, UnitedHealth may well (and likely will) push through whatever the future holds. As it stands right now, though, there’s too much risk and too much uncertainty for too little upside to justify holding this name. More clarity is needed, and that’s going to take more time than has been given. There are better investment options to consider in the meantime.