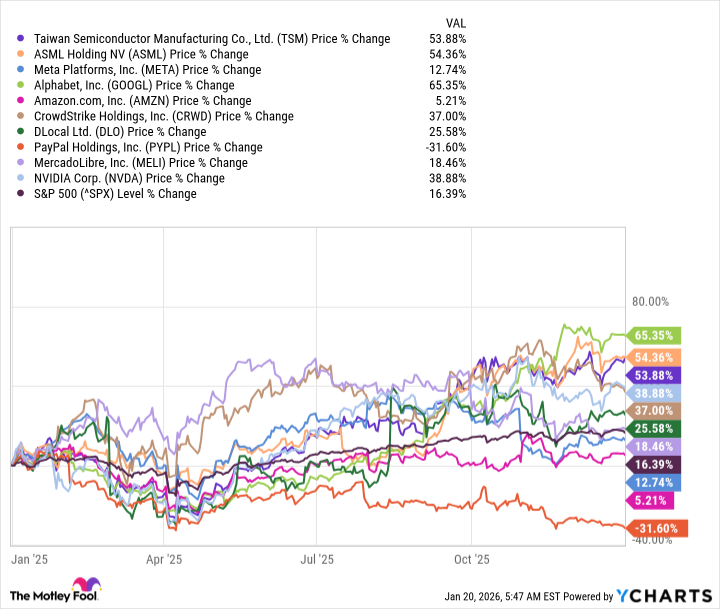

The market delivered a strong gain in 2025, but it was no match for these stock picks.

In December 2024, I gave investors my top 10 stocks for 2025. They included (in no particular order):

- Taiwan Semiconductor Manufacturing (TSM +2.20%)

- ASML (ASML 0.57%)

- Meta Platforms (META +2.55%)

- Alphabet (GOOG 0.36%) (GOOGL 0.42%)

- Amazon (AMZN +2.26%)

- CrowdStrike (CRWD 0.06%)

- dLocal (DLO +2.55%)

- PayPal (PYPL 1.16%)

- MercadoLibre (MELI 1.92%)

- Nvidia (NVDA +1.42%)

If you followed my advice and bought these stocks last year, you’re a very happy investor. Seven of the 10 outperformed the S&P 500 (^GSPC +0.04%), with six of them increasing by more than 25% in the year.

Data by YCharts.

However, there’s a natural tendency for investors to assume that stocks may underperform the year after they had a great run. So, are any of these stocks that rose by more than 25% in 2025 worth buying in 2026?

Image source: Getty Images.

Many of the stocks are still strong buys

The six that increased by 25% or more during 2025 were dLocal, CrowdStrike, Nvidia, TSMC, ASML, and Alphabet. Of these six, I think Nvidia, TSMC, and dLocal can each deliver a repeat of 2025’s performance and increase by at least 25%.

Nvidia and TSMC are key hardware providers in the artificial intelligence (AI) arms race. Nvidia makes graphics processing units (GPUs), which have become the industry standard to train and run generative AI workloads on. TSMC makes the logic chips that go into these devices, and each is benefiting from massive AI spending. Because AI spending isn’t expected to slow down anytime soon, I think these stocks are slated to deliver monster returns again in 2026.

Today’s Change

(1.42%) $2.63

Current Price

$187.47

Key Data Points

Market Cap

$4.5T

Day’s Range

$186.83 – $189.60

52wk Range

$86.62 – $212.19

Volume

3.7M

Avg Vol

186M

Gross Margin

70.05%

Dividend Yield

0.02%

dLocal provides payment processing plug-ins for companies to deploy so they can access third-world country markets. I think there is huge room to run in this space, but part of 2025’s performance came from the stock trying to claw back to previous highs, as it’s still down 80% from its all-time high.

I think all three of these stocks could deliver at least 25% returns in 2026, but what about the others?

The others could still beat the market

I still like CrowdStrike, ASML, and Alphabet as investments, but I don’t think they will repeat 2025’s performance of 25% or greater rise. All of these stocks have become fully valued and present some valuation risk. ASML and Alphabet trade at 43 times and 29 times forward earnings, respectively. For their growth rates, those are full valuations and may inhibit further gains.

Data by YCharts.

CrowdStrike is also richly valued at 25 times sales, although for its performance, that isn’t out of line for a software company.

These high valuations could cause issues in 2026, but I still think they will deliver enough performance to beat the market in 2026.

Keithen Drury has positions in Alphabet, Amazon, CrowdStrike, DLocal, MercadoLibre, Meta Platforms, Nvidia, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Alphabet, Amazon, CrowdStrike, MercadoLibre, Meta Platforms, Nvidia, PayPal, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends DLocal and recommends the following options: long January 2027 $42.50 calls on PayPal, long January 2027 $7 calls on DLocal, short January 2027 $10 calls on DLocal, and short March 2026 $65 calls on PayPal. The Motley Fool has a disclosure policy.