Despite a $200,000 household income, one couple questioned whether an $800,000 home was holding them back financially.

Jessica, 28, told “The Ramsey Show” that she and her husband have budgeted for years but continued carrying debt because the payments felt manageable. The couple owns a home valued at up to $850,000 and owes about $480,000 on the mortgage.

“We’ve always maintained debt,” Jessica said. She asked whether selling the house, renting for a period, and using the equity to pay off balances and rebuild savings would be the right move.

Don’t Miss:

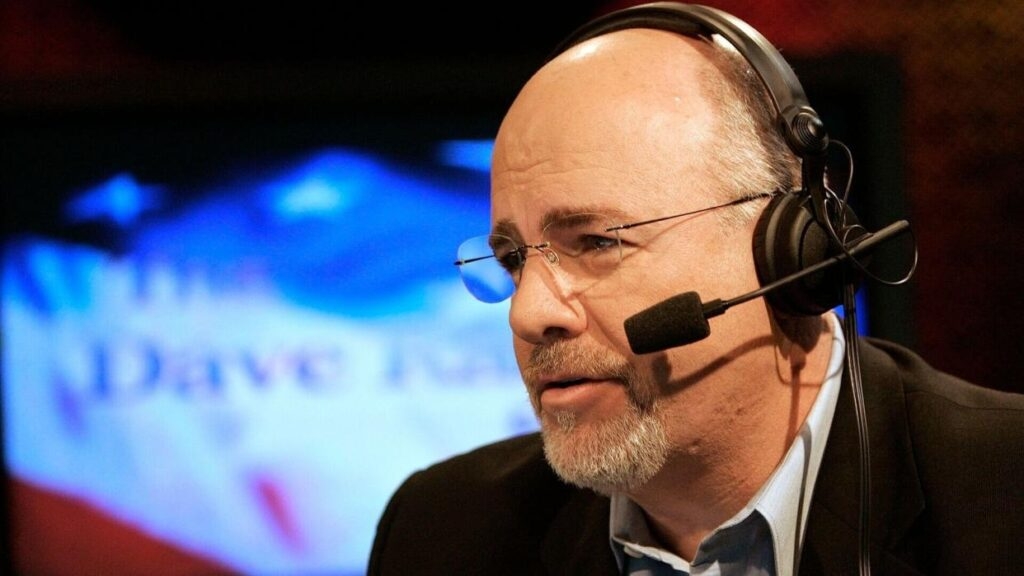

After reviewing the numbers, personal finance expert Dave Ramsey rejected that approach. “Quit being a couple of $200,000-a-year spoiled freaking brats,” he said, reacting to how the income had been handled alongside ongoing debt.

High Income, Lingering Debt

Jessica said their balances include about $70,000 on a home equity line of credit, roughly $70,000 across two vehicle loans, and a $16,000 camping trailer. One vehicle carries a monthly payment of about $700, while the other is around $600.

“You make too much money to be this broke,” Ramsey said, pointing to the gap between earnings and results.

Jessica also mentioned plans to move to Utah, though not for another four to five years. She said her husband’s parents live just down the street and help care for their child while she and her husband are at work, making an immediate move difficult.

Trending: Bezos’ Favorite Real Estate Platform Launches A Way To Ride The Ongoing Private Credit Boom

Ramsey said selling the house now and renting would not make sense given that timeline. He told Jessica the house itself was not causing the problem and warned that paying off debt without changing habits would likely lead to balances returning.

‘Skinny Fat’ Finances

Co-host Jade Warshaw added that high income can create what she called “skinny fat” finances, where things appear stable on the surface but weaknesses remain underneath.

“Just because it looks healthy doesn’t mean it actually is,” she said.

Ramsey said the couple could put about $10,000 a month toward debt and be finished in roughly 14 months. That plan would require cutting discretionary spending and selling nonessential items, including the trailer, but keeping the house.

“This process of 14 months of sacrifice, y’all are never going to be the same,” Ramsey said, adding that selling the house would not change behavior.

See Also: Wall Street’s $12B Real Estate Manager Is Opening Its Doors to Individual Investors — Without the Crowdfunding Middlemen

High incomes don’t automatically make financial decisions easier. Whether priorities are housing, debt, childcare, or future goals, cash flow alone may not provide clarity.

Domain Money offers free strategy sessions with CFP professionals and focuses on personalized financial planning for U.S. households earning $100,000 or more. The goal is to help people weigh tradeoffs, set priorities, and connect today’s decisions with longer-term outcomes.

A structured plan can help clarify what actually moves the needle — without extreme cutbacks or starting over for short-term relief.

Read Next: This investment firm leverages expert insights and a 2.40x net equity multiple to help accredited investors capitalize on 2026 multifamily market trends—read the full forecast now.

Image: Shutterstock