Investors in a catastrophe bond tied to Jamaica look set to experience a trigger event as Hurricane Melissa barrels toward the Caribbean island as a Category 5 storm.

“Based on current models there is a high chance that there will be at least a partial payout” of Jamaica’s cat bond, said Florian Steiger, chief executive of Icosa Investments AG, a Swiss investment firm specialized in alternative fixed-income strategies.

If accurate, the projection means Hurricane Melissa is on track to force a scenario that catastrophe bond investors dodged when Hurricane Beryl hit in 2024. Jamaica’s $150 million cat bond, which was arranged by the World Bank, is designed as the ultimate backstop to help provide funds to pay for only the most extreme weather events.

Market participants now estimate that Hurricane Melissa’s current trajectory means Jamaica’s cat bond should be trading at “a substantial discount of likely more than 30%” ofits nominal value, Steiger said.

Jamaica, which the World Bank estimates is the third most-exposed country to natural catastrophes, has built up several layers of disaster risk financing, including pre-arranged credits and parametric insurance. Its cat bond sits at the very top of the insurance tower as protection against extreme events. The bond came under scrutiny last year when Hurricane Beryl caused large economic losses but narrowly missed triggering a cat-bond payout.

Hurricane Melissa “is a second chance,” said Steiger of Icosa, whose cat-bond funds hold about $600 million in assets. Even a partial payout “will be put to good use and can make a huge difference to the people.”

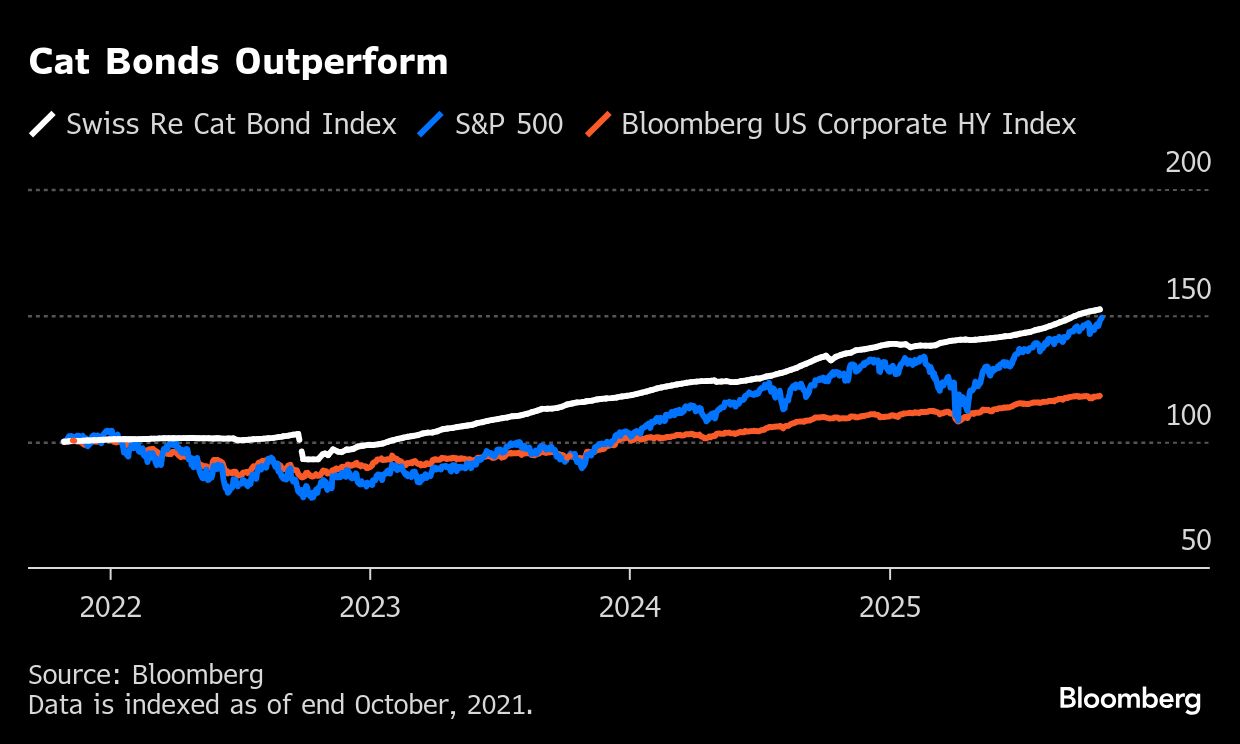

Cat bonds allow issuers — often insurers but sometimes also whole countries — to pass part of their risk to capital markets. Sales of the instruments have soared amid increasing risk from property exposure, inflation and climate change. Investors can face potentially large losses if a bond is triggered, but stand to generate significant returns if a predefined catastrophe doesn’t occur.

Depending on exactly where Melissa hits Jamaica, total losses may range from $5 billion to $16 billion, according to Chuck Watson, a disaster modeler with Enki Research.

To be sure, even a full $150 million payout of Jamaica’s cat bond isn’t likely to have a big impact on investor portfolios because it makes up a tiny portion of the $55 billion market for the securities.

Plenum Investments AG has estimated that a full payout would have only a 0.23% impact on one of its two cat bond funds, while the other would be untouched. Plenum said last week that Melissa’s impact on the overall cat bond market “appears limited,” adding that Melissa is “unlikely to make landfall along the US coast” — a scenario that still holds.

Cat bonds have delivered record returns since 2023 and investors have dodged major losses so far this year, despite forecasts of an above-normal US hurricane season. Returns for the year currently stand at 10% according to the Swiss Re Cat Bond Total Return Index.

Copyright 2025 Bloomberg.

Topics

Catastrophe

Interested in Catastrophe?

Get automatic alerts for this topic.