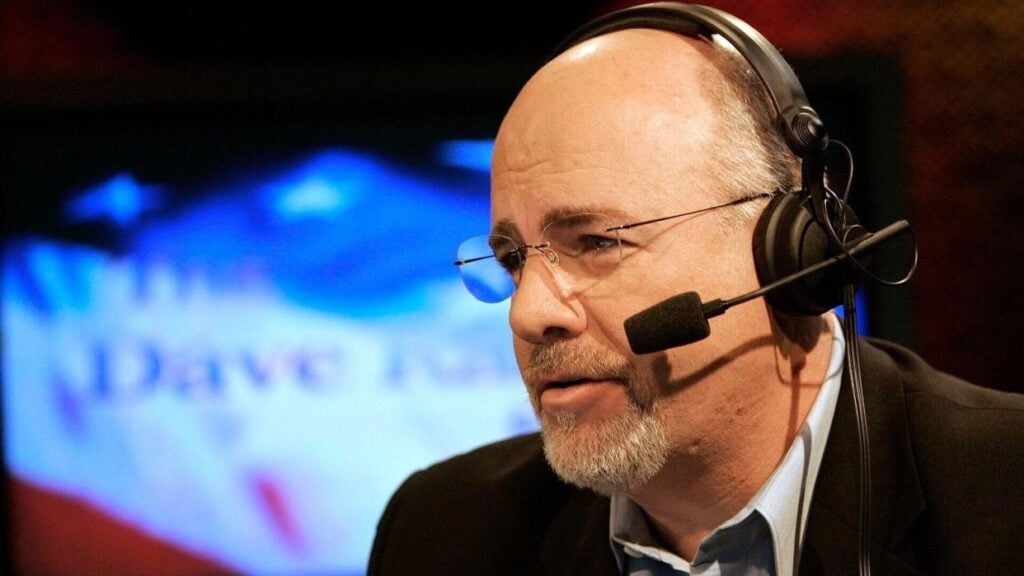

Dave Ramsey has become one of the wealthiest and most well-known personal finance figures in the U.S. By the age of 26, he was earning about $250,000 a year and had built a net worth of roughly $1 million, only to lose it all when his highly leveraged real estate investments ran into trouble. After declaring bankruptcy, he rebuilt his finances and became a leading financial educator.

Ramsey saw the highest annual income of his career this year, with his company Ramsey Solutions generating about $300 million, he said during an interview on “The School of Hard Knocks” YouTube channel.

“God’s been good to me,” Ramsey said.

Don’t Miss:

Ramsey said he owns about $850 million worth of real estate, accumulated without relying on debt. When asked by host James Dumoulin why he doesn’t borrow money to scale like big companies, Ramsey said that debt brings risk, and using cash ensures his business can withstand a major setback.

“Debt equals risk and the borrower is slave to the lender,” he said. “We’ve gone slowly because we did it with organic cash and so it took us a while.”

‘Really, Really Good Investment’

When asked how he managed to acquire these properties, Ramsey said he built his real estate portfolio patiently over time. He added that the headquarters campus of his company, Ramsey Solutions, is valued at around $650 million.

Trending: $100k+ in investable assets? Match with a fiduciary advisor for free to learn how you can maximize your retirement and save on taxes – no cost, no obligation.

“The first time we bought this particular piece of acreage, it was $10 million for 48 acres, a long time ago,” Ramsey told Dumoulin. “We didn’t have the money to do anything with it. We just bought the dirt. When we got the money and we began to save and watch the cash flow, and company was growing and just kept dumping everything we made into this concrete thing here, and it turned out to be a really, really good investment.”

‘Crazy Cash Flows’ From Real Estate

Ramsey told Dumoulin that he bought several properties during the 2008 financial crisis because prices were attractive, and those investments later proved profitable. He believes real estate built without debt can generate “crazy cash flows” if managed properly, and the first property may be the hardest to acquire but can lead to more over time.

“You get this positive snowball working in your favor,” Ramsey said. “The hardest one is the first one. But if you buy good properties and you know how to manage them and you get the cash coming in off of them, it’ll lead you into another property.”

Read Next:

Image: Shutterstock