Just nine Fugitive Economic Offenders (FEOs) owed Indian banks over ₹58,000 crore in principal and interest. Despite having arrest warrants issued against them, these FEOs have left India and refuse to return to avoid criminal prosecution. Of this, the principal amount owed is ₹26,645 crore, while interest accounts for ₹31,437 crore. To date, banks have recovered just over ₹19,000 crore — roughly 33% of the total dues.

Earlier this week, the Ministry of Finance informed Parliament that 15 individuals had been declared FEOs as of October 31. Nine of them are involved in large-scale financial fraud, and the amounts they owe have been made public.

State Bank of India (SBI) is owed over ₹22,000 crore, followed by Punjab National Bank and Bank of India. The chart below shows the Amount owed to the banks and the amount recovered.

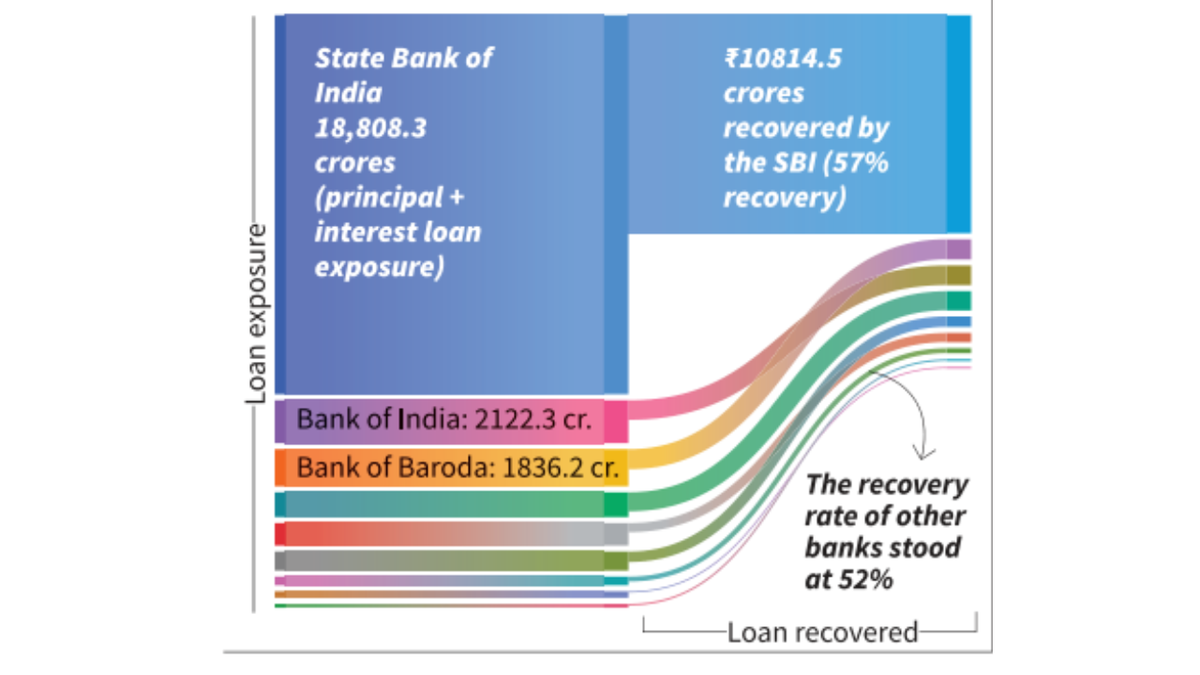

Notably, the SBI has achieved the highest recovery rate among these lenders, retrieving close to 52%. This is largely attributed to effective recovery measures, including liquidation, in Vijay Mallya’s account. In contrast, the recovery rate for other banks remains below 40%.

In terms of total dues owed initially (principal plus interest), businessman Mallya tops the list with nearly ₹27,000 crore. The chart below shows the amount owed by the offenders and the amount recovered.

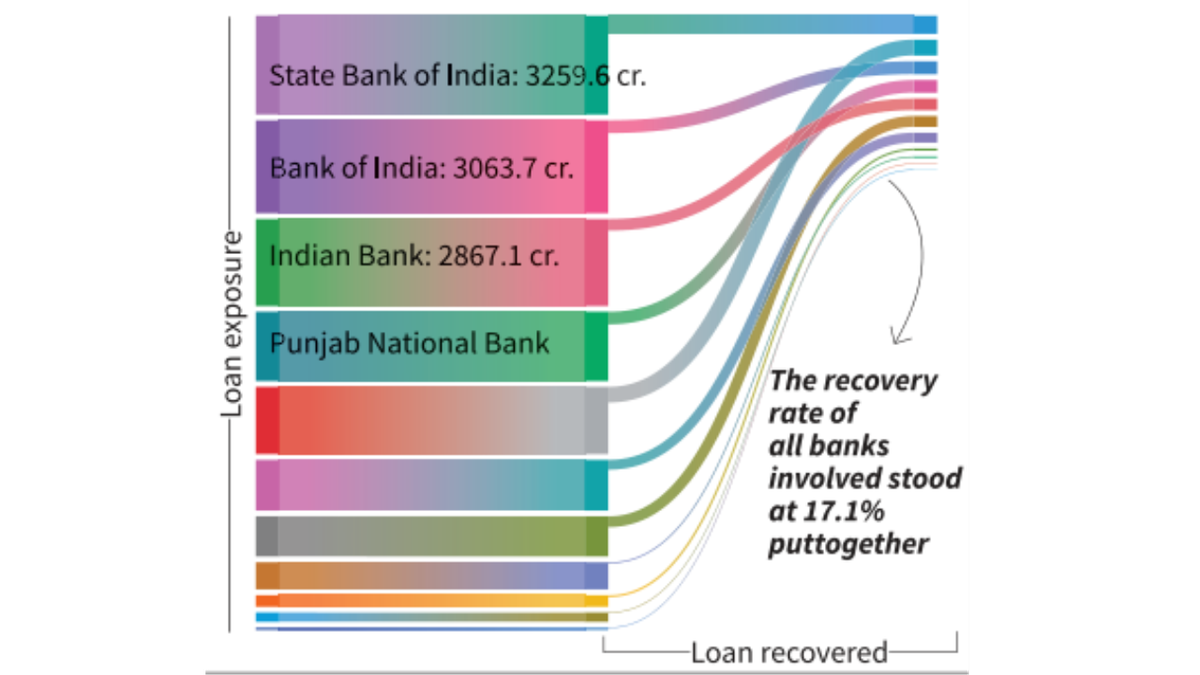

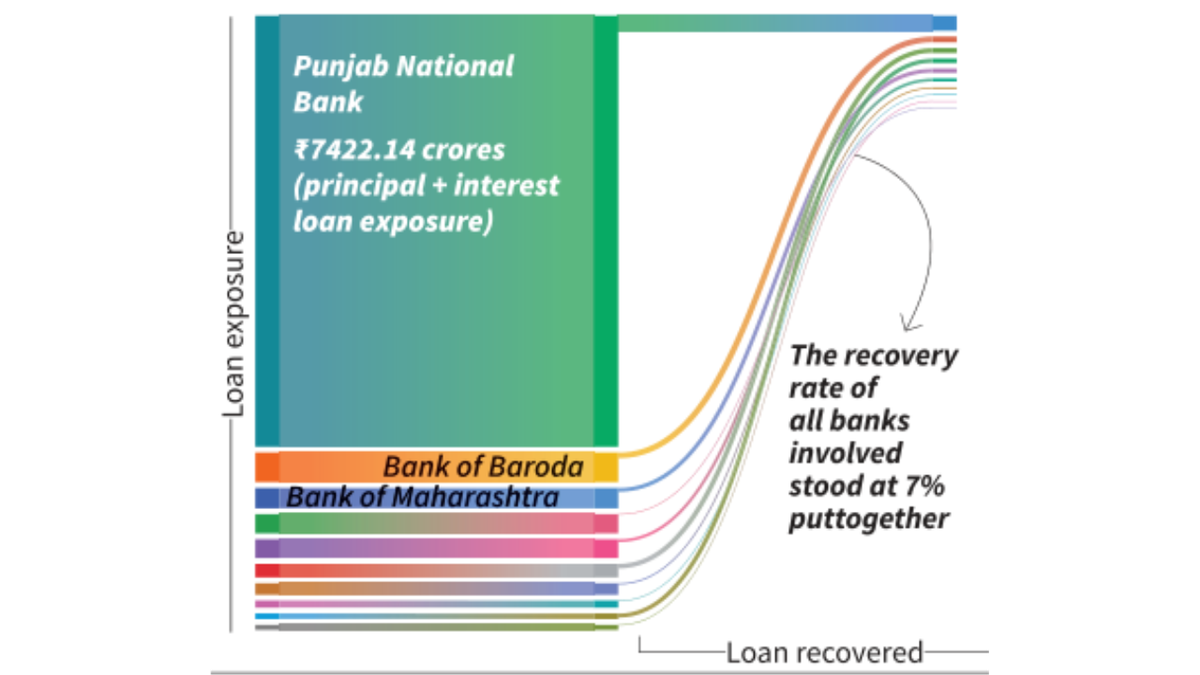

He is followed by the Sandesara family (Sterling Group) and Nirav Modi. Over 56% of amount owed by Mallaya has been recovered till date, date show, while for others, the rate is much lower at 17% for the Sandesara family and 7% in the case of Modi.

The charts below detail the loan exposure and recovered amount for the top offenders. SBI led in exposure to Mallya, whereas PNB bore the brunt of Modi’s defaults. For the Sandesara family, the exposure was shared among multiple banks.

The chart below details the loan exposure of various banks and the recovered amount in accounts related to Vijay Mallya

The chart below details loan exposure and the recovered amount in accounts related to the Sandesara family

The chart below details loan exposure and the recovered amount in accounts related Nirav Modi

The data for the charts were sourced from Parliament Questions and Answers. This analysis includes the two fugitive economic offenders who have negotiated loan settlement under One Time Settlement (OTS). In the graphs, members of the Sandesara family refers to amount borrowed by/recovered from Nitin J. Sandesara, Chetan J. Sandesara, and Dipti C. Sandesara as mentioned in the parliament document

Published – December 05, 2025 08:00 am IST