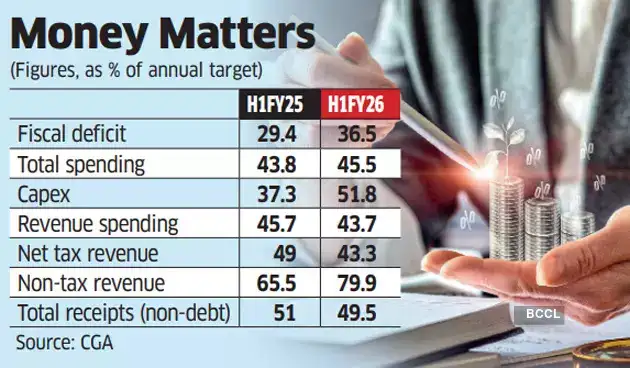

In absolute terms, the fiscal deficit between April and September hit ₹5.73 lakh crore, against ₹4.75 lakh crore a year before, the data showed.

However, in September alone, the centre witnessed a fiscal surplus of ₹25,030 crore, against a deficit of ₹39,344 crore a year earlier. This led to an improvement in fiscal deficit, which had hit 38.1% of the full-year target until August.

Last month, economic affairs secretary Anuradha Thakur had exuded confidence that the Centre would meet its target of containing its 2025-26 fiscal deficit at 4.4% of gross domestic product.

The latest data showed capital expenditure surged 40% in the first half of this fiscal from a year before to ₹5.80 lakh crore, thanks to sustained push for infrastructure creation, a spike in disbursement of loans and advances, and a favourable base.

The government, however, kept a lid on revenue spending-which grew just 1.5% to ₹17.23 lakh crore- to maintain fiscal balance in times of a contraction in net tax mop-up. Total spending, consequently, rose 9.1% to ₹23.03 lakh crore.

Net tax revenue contracted 2.8% in the first half of this fiscal from a year before to ₹12.29 lakh crore. However, the contraction in net tax revenue narrowed from 7.3% until August, thanks to a 7.1% rise in mop-up in September alone.The drop in net tax revenue in the first half was driven by a subdued 2.8% rise in gross tax revenues and a sharp 16% increase in resource devolution to states. “With an asking growth rate of over 21% in H2 FY2026 to meet the FY26 budget estimate, we are apprehensive that taxes will undershoot the budgeted target,” said ICRA chief economist Aditi Nayar.However, Nayar doesn’t foresee a “material slippage” in the fiscal deficit relative to the target of 4.4% of GDP, expecting the typical trend of expenditure savings and higher-than-budgeted non-tax revenues to absorb any shortfall in tax revenues. The data showed non-tax revenue jumped 30.5% to ₹4.66 lakh crore in the wake of a record ₹2.69 lakh crore dividend transfer by the central bank. Total receipts increased 5.7% year-on-year until September to ₹17.3 lakh crore.

Subdued retail and wholesale inflation are impacting the pace of growth in the tax collection and has complicated the fiscal arithmetic, said India Ratings associate director Paras Jasrai. “Everything hinges on how the GST rate rationalisation impacts consumption demand in the economy. The early signs of which (through a strong festive season for durables) are encouraging,” he added.

In September alone, while capital spending rose almost 31% in September to ₹1.49 lakh crore, revenue expenditure dropped 20.8% to ₹2.73 lakh crore. Overall receipts rose 6.6% in September to ₹4.48 lakh crore.