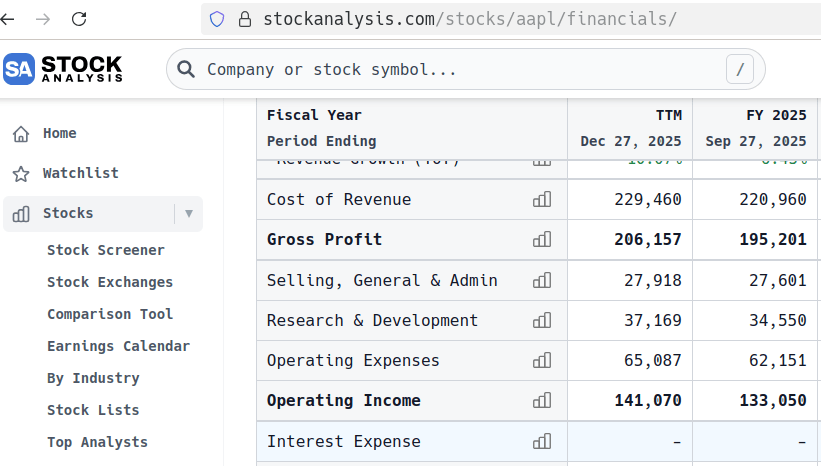

In stockanalysis.com:

The Interest Expense is --,It means that Apple Inc. (AAPL)’s net interest expense for fiscal year 2025 is less than 1 million Dollors(unit is million) or not?

In yahoo finance:

The Interest paid supplemental data is -- also.

Here is apple 2025 10-K report,how can get net interest expense?

I have the idea to get AAPL’s net interest expense for fiscal year 2025:

formula 1:

FCFF = CFO + Net Interest Expense × (1 - Tax Rate) - FCInv

data :

CFO = Cash Flow from Operations , 111.482 billion

FCInv = Fixed Capital Investment ,or say Capital Expense ,or say Depreciation and Amortization 12.715 billion

Tax Rate: 20,719,000,000 / 132,729,000,000 ≈ 16%

FCFF = CFO + Net Interest Expense × (1 - Tax Rate) - FCInv

= 111.482 - Net Interest Expense × (1-0.16) - 12.715

= 98.767 - 0.84 × Net Interest Expense

formula 2:

FCFF = EBIT × (1 - Tax Rate) + FCInv - FCInv - ΔNWC

data:

EBIT: 133.05 billion

FCInv: 11.698 billion

ΔNWC (Change in Net Working Capital):

2025 NWC = Current Assets - Current Liabilities = 147,957,000,000 - 165,631,000,000 = -17,674,000,000

2024 NWC = 152,987,000,000 - 176,392,000,000 = -23,405,000,000

ΔNWC = 2025 NWC - 2024 NWC = -17,674,000,000 - (-23,405,000,000) = 5,731,000,000 = 5.7 billion

FCFF = EBIT × (1 - Tax Rate) + FCInv - FCInv - ΔNWC

= 133.05 × 0.84 + 11.698 - 12.715 - 5.7

= 105.045

Get the equation:

98.767 - 0.84 × Net Interest expense = 105.045

Solve it :

Net Interest expense = -7.4738 billion = -7473.8 million

A number this large is impossible for Apple to overlook. What’s the truth behind it?