Budget 2026: The power of one rupee

Indian movies have often glorified the power of one rupee. Think of the Indian Budget like a Rajnikanth’s Shivaji moment for the Indian state: What begins as one rupee collected from citizens does not sit idle, but is set to work with intent and attitude. That single rupee is broken up, pooled with millions of others, and turned into roads, railways, defence hardware, school classrooms, hospital beds and digital pipes that keep the economy moving.

Part of it goes to paying interest and keeping the government’s books credible, part to welfare that cushions the poor, and part to capital spending meant to create the next round of growth and jobs. The message, much like Rajinikanth’s in Shivaji: The Boss, is simple and theatrical at once, it is not the size of the rupee that matters, but how decisively it is deployed. The Union Budget 2026 is the script showing exactly where that rupee goes and what it is expected to return.

Budget: Where does every rupee come from and go

Every Budget comes with big numbers, but the real story is hidden in the smallest unit — one rupee. Ever wondered where that rupee in the government’s pocket actually comes from, and where it finally goes? Break it down paise by paise, and the Union Budget starts to look less intimidating and far more revealing. Here’s a simple walk-through of how the government planned to earn and spend each rupee in the previous Union Budget, and what those choices said about taxes, borrowing and priorities.

In the previous Union Budget presented in 2025, for every rupee in its coffers, the largest share, 66 paise, was estimated to come from direct and indirect taxes. The remaining revenue was budgeted to be sourced from borrowings, non-tax revenue, and capital receipts.

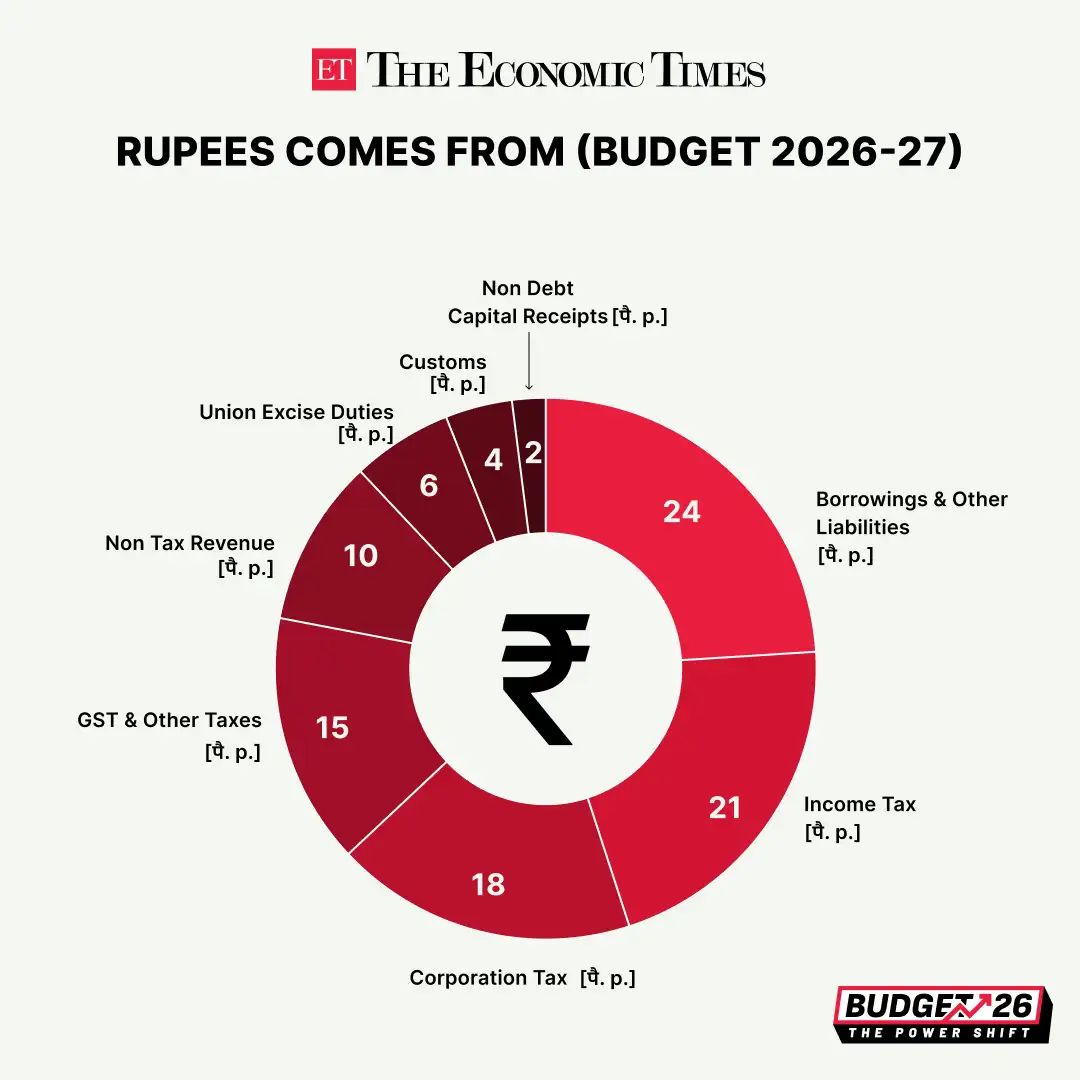

Union Budget: Where does government get money from

For the next financial year starting April 1, the bulk of money is expected to come from borrowings and other liabilities, while the money you pay as income taxes sits second in the list. In Budget 2026, the government expects 24 paise to come from borrowings and other liabilities out of every rupee earned, while income tax will contribute 21 paise. Next in line is the corporate tax, which contributes 18 paise out of evey rupee the Indian government will earn in fiscal 2027. GST & other taxes are projected to contribute 15 paise, non-tax revenue 10 paise, union excise duties 6 paise, customs 4 paise and net debt capital receipts 2 paise.

ET Online

ET OnlineIn the 2025 India Budget, out of every rupee the government earned, 39 paise was budgeted to come from direct taxes. This included 22 paise from income tax paid by individuals and 17 paise from corporate tax. Among indirect taxes, GST was projected to bring in 18 paise, making it the biggest source in this category. Excise duty was budgeted to add 5 paise, while customs duty would contribute 4 paise. Apart from taxes, borrowings and other liabilities were projected to provide 24 paise. Non-tax income, including money from disinvestment, would add 9 paise, and non-debt capital receipts would contribute 1 paise.

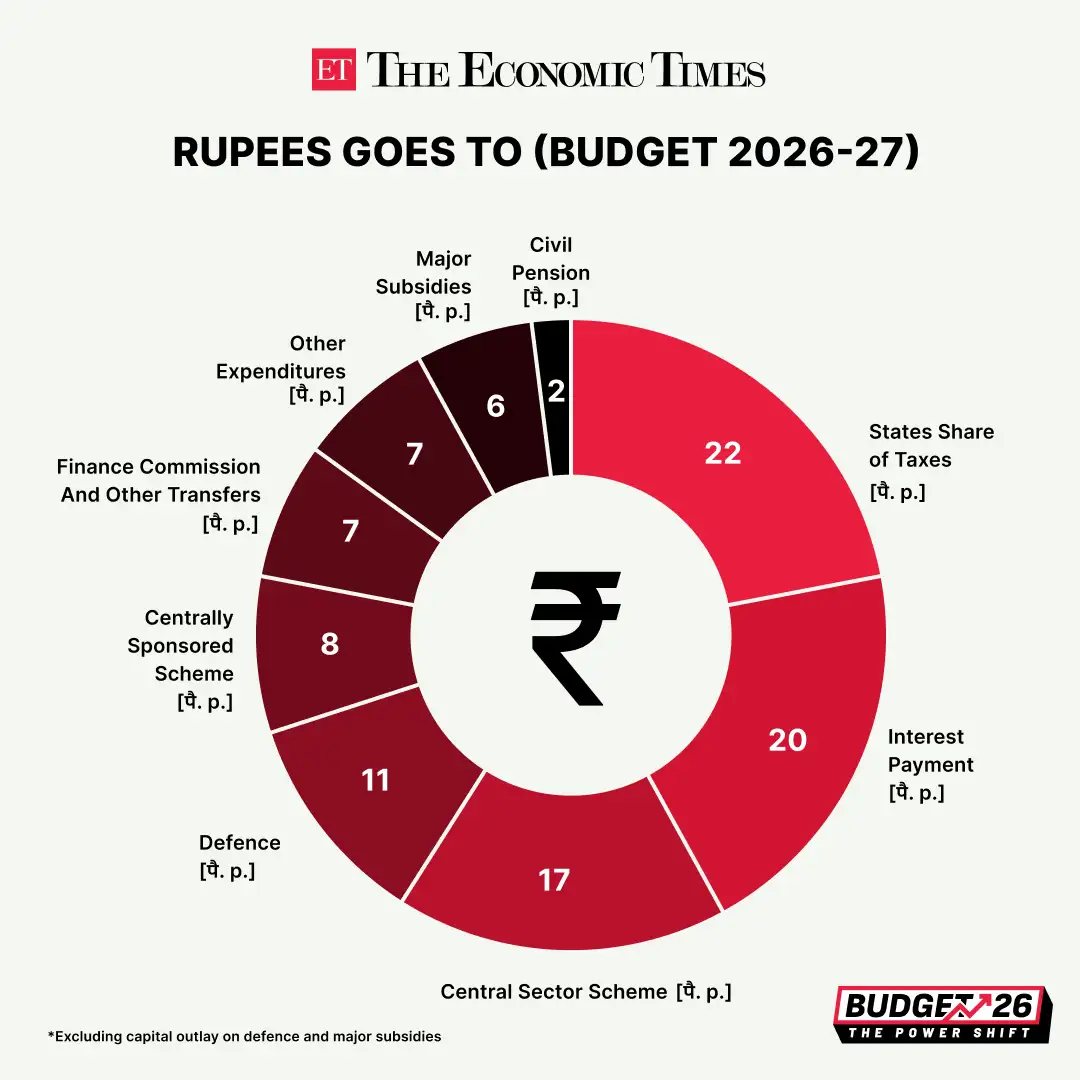

Budget 2026: How the government spends money

On the spending side, the largest share, 22 paise out of every rupee, was budgeted to go to states as their share of taxes and duties. Interest payments would take up 20 paise. The government projected to spend 17 paise on central sector schemes and 8 paise on centrally sponsored schemes. Defence is next in line to get the most money, as it will receive 11 paise out of every rupee that the government will spend. Finance Commission & other transfers, other expenditures, major subsidies and civil pension will get 7 paise, 7 paise, 6 paise and 2 paise, respectively.

ET Online

ET OnlineIn the previous Budget too, the largest share, 22 paise out of every rupee, was budgeted to go to states as their share of taxes and duties. Interest payments was allocated 20 paise. The government projected to spend 16 paise on central sector schemes and 8 paise on centrally sponsored schemes.

Defence was supposed to receive 8 paise, while Finance Commission transfers would account for another 8 paise. Subsidies was budgeted to get 6 paise, and pensions would take 4 paise. The remaining 8 paise was projected for use of other expenses, including administration and governance costs.

.avif?ssl=1)