If the use cases for quantum computing live up to the hype, IonQ investors could see huge returns.

The discussion surrounding quantum computing and its potential use cases has dominated much of the tech headlines in 2025. One of the up-and-coming players is IonQ (IONQ +4.23%), which makes a trapped-ion system that seeks to solve complex problems more efficiently. If the demand and applications for its technology live up to the hype, IonQ could potentially be the next Nvidia.

IonQ’s ability is promising

IonQ is moving in the right direction and recently revised its full-year guidance upward to between $106 million and $110 million. In its latest quarter, the company reported a 222% year-over-year increase in revenue.

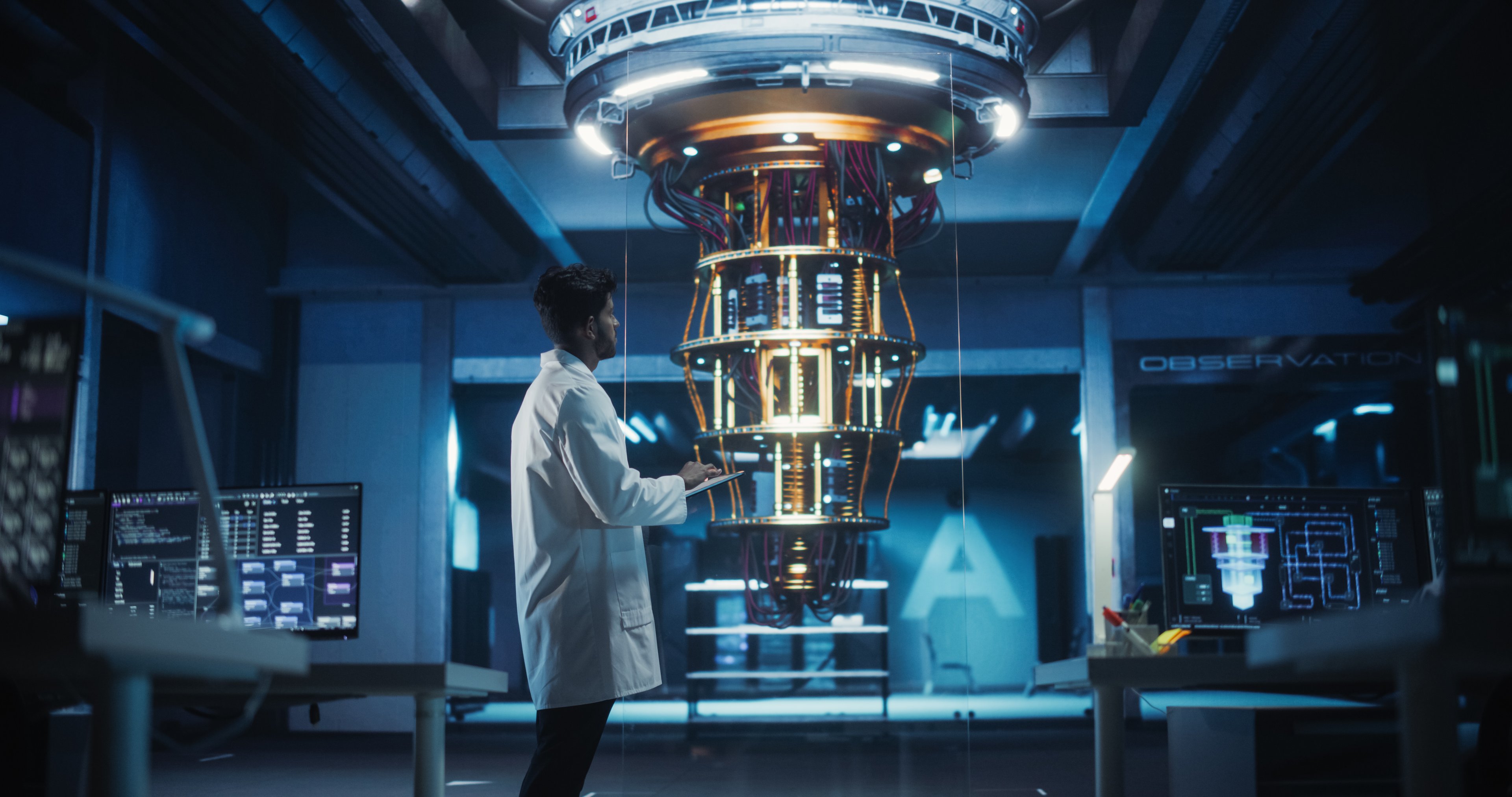

Image source: Getty Images.

IonQ also set a world record for 2-qubit gate performance in 2025, with fidelity exceeding 99.99%. IonQ is the only quantum computing company in the world to cross the “four-nines” benchmark. This is a landmark technical achievement, positioning IonQ well to capture a significant share of the future quantum computing market. It already touts an impressive who’s who of customers and partners.

IonQ could be a moonshot if the company can deliver on its technology roadmap. The plan is to deploy the world’s most powerful quantum computers by 2030 with 2 million qubits. IonQ anticipates that this will have significant implications for drug discovery, materials science, financial modeling, cybersecurity, and defense.

Today’s Change

(4.23%) $1.90

Current Price

$46.77

Key Data Points

Market Cap

$17B

Day’s Range

$43.80 – $47.09

52wk Range

$17.88 – $84.64

Volume

17M

Avg Vol

26M

Gross Margin

-747.41%

How big is the quantum computing market?

Skeptics will tell you that IonQ will crash land because quantum computing isn’t as effective or applicable in real life as we’d hoped. Five years from now, we’ll likely know if the skeptics were correct or off-base.

IonQ’s shareholders have experienced quite a roller-coaster ride over the past year, as the stock peaked at over $84 but has since returned to more reasonable levels. IonQ is still at a premium valuation, but that won’t matter to long-term investors if the company can seize on the opportunity in the next five years. If you’re a risk-tolerant investor who believes quantum computing is revolutionary, IonQ looks ready to capitalize.

Catie Hogan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends IonQ and Nvidia. The Motley Fool has a disclosure policy.