UK exports to US plunge by record amount after Trump tariffs

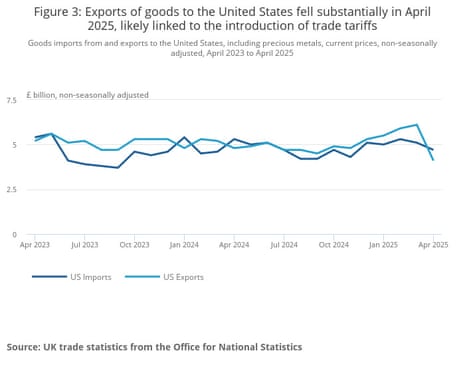

UK trade with the United States plunged in April, as Donald Trump’s announcement of new tariffs hit demand for goods.

Exports of UK goods to the United States fell by £2bn in April, the Office for National Statistics reports, which is another factor why the UK economy shrank so sharply during the month.

This is the largest monthly decrease in trade with the US since records began in January 1997 and follows four months of consecutive increases.

The ONS says this decline is “likely linked to the implementation of tariffs on goods imported to the United States”.

Today’s trade data shows there was a fall in exports of cars, non-ferrous metals and chemical exports to the US in April.

On 2 April, Trump announced that imports from the UK would face a blanket 10% tariff under his new trading system. UK steel producers and carmakers faced higher tariffs, although these should fall under the US-UK trade deal agreed in May.

ONS Director of Economic Statistics Liz McKeown says:

“After increasing for each of the four preceding months, April saw the largest monthly fall on record in goods exports to the United States with decreases seen across most types of goods, following the recent introduction of tariffs.”

Key events

Euro highest since late 2021

With the dollar weakening, the euro has hit its highest level since late 2021.

The single currency has gained more than a cent today, hitting $1.16 for the first time since November 2021.

Other currencies are also climbing against the dollar; the Swiss franc rose 0.8% to 0.8138 versus the greenback, its highest level since April 22, while Japan’s yen climbed 0.6% to 143.70.

The pound has gained half a cent, to $1.359.

US dollar hits three-year low

Back in the financial markets, the US dollar has dropped to a three-year low against a basket of currencies.

The dollar index has lost 0.7% of its value today, hitting its lowest level since March 2022.

The decline comes after Donald Trump yesterday threatened to set unilateral tariff rates on US trading partners, a blow to hopes of a negotiated end to the trade war.

Vasileios Gkionakis, senior economist and strategist at Aviva Investors, fears that the “risk premia” on the US dollar is rising, as investors fret about persistent fiscal deficits, weakening foreign demand for government debt, and institutional uncertainty.

Gkionakis explains:

The US has been enjoying a significant privilege for decades, with higher issuance being matched by foreign investors’ appetite for US paper.

This is now shifting, with the US likely to run large fiscal deficits for years without a commensurate fiscal impulse – and against a backdrop of an extended net international investment position. All this is agitating markets who in order to lend to the US would require a combination of higher yields and a weaker exchange rate.

In other words, the shift away from US exceptionalism is driving the US risk premium higher and is weighing on the value of the dollar. Indeed, our estimate of the US10Y risk premium has correlated rather well with the dollar movements since April.

Economic warning signs are flashing over the UK economy, warns Kate Nicholls, chief executive of UKHospitality, following April’s 0.3% drop in GDP.

Nicholls blames the cost increases which hit businesses in April, including higher naional insurance contributions (which were also blamed for a rise in unemployment earlier this week).

She says:

“GDP figures can be volatile but an immediate shrinking of the economy and more than 100,000 jobs lost in just a month shows that the huge increase to employer NICs is putting the brakes on growth.

Hospitality is a resilient sector and businesses are doing all they can to trade their way out of these challenges, but it has the potential to be the engine for growth if it is properly backed.

“The economy only grows when hospitality is strong. The Government needs to take these warning signs seriously and urgently review and reverse the changes to NICs, while bringing forward clear plans to empower hospitality and the high street.

Helena Horton

In Britain’s agriculture sector, the National Farmers’ Union has accused Defra’s Steve Reed of “misleading” spending review claims over the farming budget.

The department has claimed payments for the nature-friendly farming programme, called the Environment Land Management Schemes, will “skyrocket” from £800m in 2023/24 to £2bn in 2028/29. This, on the face of it, looks like a large funding increase and has been reported by some as such.

However, it doesn’t look to be. This is because after the UK left the EU, farmers were promised that their subsidies would be the same as they were under the EU, and were promised a figure of £2.4bn a year.

The Tory government at the time decided that rather than being paid per acre, farmers should be paid for improving nature so devised the ELMS schemes, but while these got up and running the acreage payments known as Basic Payments Schemes (BPS) were kept. These would be cut each year as the ELMS increased and are due to be phased out entirely by 2028.

So, farmers currently get the £2.4bn a year in two streams – the ELMS and the BPS – as well as a smaller amount of money in grants for things like robotics trials.

By 2028/29 they will not be paid BPS so will only get ELMS and this will have a value of £2bn. There may be some other grants available to top this up, but this has not been confirmed.

In reality, the government has promised an average of £2.3bn a year up to 2028/29 for the farming budget, which is a £100m a year cut, and by the end of the spending period it looks like the budget shrinks to not much more than £2bn.

NFU senior economist Sanjay Dhanda has said Defra has been “misleading” in its claims.

He said:

“A key pillar of Defra’s budget is the continued investment in ELMs, with funding set to rise to £2 billion by 2028/29 compared to the £1.8 billion earmarked in the Autumn 2024 budget. While the government has framed this as a significant uplift from the £800 million spent in 2023/24, this comparison is misleading as ELMs was not fully operational at that point, and de-linked payments (BPS) absorbed a large share of funding.

“The actual increase is a modest £200 million over four years – barely sufficient to keep pace with inflation, let alone scale up delivery.”

UK trade deficit widens….

The tumble in exports to the US in April helped to widen the UK’s trade deficit.

In April alone, UK goods exports fell by £2.7bn – of which £2bn was the decline in sales to the US, plus a £600m drop in exports to the EU.

Overall, the UK’s trade in goods deficit widened by £4.4bn to £60.0bn in the February-April quarter.

That more than surpassed the services sector’s surplus, which fell by £500m to £48.5bn over the quarter.

The total underlying trade deficit widened £4.9bn to £11.5bn in the 3 months to April 2025, because of a larger rise in imports than exports. pic.twitter.com/V8uNGPjGHe

— Office for National Statistics (ONS) (@ONS) June 12, 2025

Joanna Partridge

In the travel sector, disruptive Ryanair passengers whose behaviour results in them being removed from the plane will be fined £500.

Europe’s biggest airline said this would be the “minimum” punishment and that it would continue to pursue ejected passengers for civil damages.

European markets fall amid new trade tensions

This morning’s disappointing UK growth, and trade, data hasn’t caused a panic in the City.

The FTSE 100 share index has dipped by just 9 points, or 0.1%, to 8855 points, having ended Wednesday near its closing high.

Other European markets are having a rather worse morning; Germany’s DAX index has dropped by 1.35%, while France’s CAC is down 1%.

Trade war fears are, again, rippling across trading floors, even though the US and China patched up their truce yesterday.

President Donald Trump has alarmed investors by revealing yesterday tht he plans to send letters to trading partners in the next couple of weeks setting unilateral tariff rates

Trump told reporters Wednesday at the John F. Kennedy Center for the Performing Arts in Washington:

“We’re going to be sending letters out in about a week and a half, two weeks, to countries, telling them what the deal is.

“At a certain point, we’re just going to send letters out. And I think you understand that, saying this is the deal, you can take it or leave it.”.

That has undermined hopes that the US might agree trading deals with its partners before the 90-day pause announced by the US president in April expired.

On Day 62 of the tariff pause, the run rate required to hit 90 deals in 90 days is now just a bit over 3 deals per day, which would be [maths it out…] roughly 3 deals per day above the current rate.

— Justin Wolfers (@JustinWolfers) June 10, 2025

Investec: April was payback time in UK monthly GDP numbers

Analysts at Investec reckon April was “payback time” for the UK economy, as shown by the 0,3% fall in GDP.

They point out that the fall in GDP was due to two factors.

The first is that frontrunning took place in the UK housing market, where homebuyers had brought forward house purchases to beat the 1 April deadline when stamp duty reverted to being imposed at lower thresholds.

This had boosted residential transactions pre-April and especially in March (+61.6%), only to then be followed by a large slump in April (-63.5%). Such swings in transaction around stamp duty changes are by no means unusual in the UK housing market: there were precedents around, for example, the end of the pandemic ‘stamp duty holiday’. This affected conveyancing solicitors as well as real estate agencies’ output negatively in April. Indeed, legal activities saw their output plunge by 10.2% on the month, having experienced a 4.1% jump in March, and ‘real estate activities on a fee or contract basis’ witnessed a 6.5% drop after a 1.8% increase in March. These two swings together sliced off 0.19%pts from monthly GDP in April, as per our calculations, and so therefore explain the bulk of its fall.

The second, of course, is that ahead of ‘Liberation Day’, the timing of which the US administration had pre-announced in February, companies had brought forward production and exports to the US market that would otherwise have taken place later on.

A fall in production in April is therefore, to some extent, payback. An example for this is likely to be the car industry: the output of motor vehicles, trailers and semi-trailers fell by 9.5% in April, having jumped by 7.4% in March. This subtracted a further 0.07%pts from monthly GDP, we calculate. Whereas this may not have been solely due to front-running to the US – the Society of Motor Manufacturers and Traders also reported model changeovers to have contributed, for instance – this seems likely to be have been an important factor.

ING: Shrinking economy is headache for Reeves

The sharper-than-forecast slide in UK GDP in April is a “headache” for chancellor Rachel Reeves, reports ING’s Developed Markets Economist, James Smith.

Smith says April was a disappointing month for the UK economy, partly because manufacturing surged earlier in the year as customers tried to avoid Donald Trump’s tariffs, leading to a fallback once they were announced.

He adds:

Yesterday’s spending review – an exercise which divvies out budgets across government departments – carried few surprises. Yet it was a reminder that there’s not enough money to go around and that the overall spending pot for the next few fiscal years will likely end up rising more quickly.

“We think the Office for Budget Responsibility is highly likely to revise down its 2026 growth forecast at the Autumn Budget later this year, which alone would wipe out half of the Treasury’s slim fiscal headroom. Further downgrades to trend productivity growth projections, as well as net migration, mean the Chancellor is likely in the red, before even considering the mounting pressures on the public purse. The overall shortfall may amount to at least £20bn, and that means tax rises are highly likely.”

Nicholas Hyett, Investment Manager at Wealth Club, blames “a cocktail of headwinds to growth” for the 0.3% fall in UK GDP in April.

Hyett says:

In the very short term the change to Stamp Duty rules have put the legal and property services on ice – with legal activities down 10.2% month-on-month.

New barriers to trade with the US and changes to employment costs, from a higher living wage and increased national insurance contributions, are a longer term challenge.

It looks like work was pulled forward to earlier in the year to avoid those headwinds and as a result we’re now seeing the inevitable economic hangover.

Weak UK GDP could prompt August interest rate cut

The drop in UK GDP in April increases the chances that the Bank of England cuts interest rates this summer, economists predict.

Paul Dales, chief UK economist at Capital Economics (who had correctly predicted April’s 0.3% fall in GDP) says:

“The 0.3% m/m fall in real GDP in April supports our view that the strength in Q1 was unsustainable. This won’t prompt the Bank of England to cut interest rates next Thursday. But it is one more piece of news pointing to another cut in August.”

The City money markets indicate there’s only a 12% chance of a rate cut this month (from 4.25% to 4%) but two quarter-point cuts before Christmas are fully priced in.

Raj Badiani, economics director at S&P Global Market Intelligence, points out that the Bank of England was already factoring in notable slower growth in the second quarter of 2025. He adds:

We still expect the Bank Rate to be maintained at 4.25% in the June meeting, to allow still troubling earnings growth to continue to ease. We anticipate the next rate cuts to occur in the August and November meetings to 3.75%, prompted by mounting economic hardships.”

Matthew Ryan, head of market strategy at global financial services firm Ebury, says traders are betting that the Bank of England will deliver another rate cut in the summer, adding:

While there is little chance of any change at next week’s meeting, we see a strong possibility that the MPC ditches its hawkish bias, which could pave the way for an August cut.”

Reeves: “uncertainty about tariffs” contributed to fall in GDP

Chancellor Rachel Reeves has said “uncertainty about tariffs” had contributed to the fall in GDP in April.

Reeves told Sky News:

“We know that April was a challenging month.

“There was a huge uncertainty about tariffs, and one of the things, if you dig into those GDP numbers today, is exports weakening and also production weakening because of that uncertainty in the world around tariffs.”

She added that the figures for April were “disappointing, but also perhaps not entirely unexpected”, given global economic uncertainty.

Charts: UK economy shrinks by most in 18 months

The 0.3% drop in UK GDP in April is the worst monthly performance by the UK economy since October 2023, when it shrank by 0.4%.

These charts show the details:

UK exports to US plunge by record amount after Trump tariffs

UK trade with the United States plunged in April, as Donald Trump’s announcement of new tariffs hit demand for goods.

Exports of UK goods to the United States fell by £2bn in April, the Office for National Statistics reports, which is another factor why the UK economy shrank so sharply during the month.

This is the largest monthly decrease in trade with the US since records began in January 1997 and follows four months of consecutive increases.

The ONS says this decline is “likely linked to the implementation of tariffs on goods imported to the United States”.

Today’s trade data shows there was a fall in exports of cars, non-ferrous metals and chemical exports to the US in April.

On 2 April, Trump announced that imports from the UK would face a blanket 10% tariff under his new trading system. UK steel producers and carmakers faced higher tariffs, although these should fall under the US-UK trade deal agreed in May.

ONS Director of Economic Statistics Liz McKeown says:

“After increasing for each of the four preceding months, April saw the largest monthly fall on record in goods exports to the United States with decreases seen across most types of goods, following the recent introduction of tariffs.”

Legal and estate agent firms suffered from April’s stamp duty changes

The increase in stamp duty payments at the start of April may also have hit growth.

Those changes meant housebuyers in England and Northern Ireland faced paying thousands of pounds more in stamp duty unless they competed their deals by the end of March – creating a cliff edge.

The post stamp duty holiday lull manifested in a 63.5% monthly decrease in UK residential transactions in April 2025. The knock on effect: legal activities output decreased by 10.2% and real estate activities on a fee or contract basis, fell by 6.5% in April 2025. @ONS pic.twitter.com/FfYA7xIDhO

— Emma Fildes (@emmafildes) June 12, 2025

ONS Director of Economic Statistics Liz McKeown explains:

“The economy contracted in April, with services and manufacturing both falling. However, over the last three months as a whole GDP still grew, with signs that some activity may have been brought forward from April to earlier in the year.

“Both legal and real estate firms fared badly in April, following a sharp increase in house sales in March when buyers rushed to complete purchases ahead of changes to Stamp Duty. Car manufacturing also performed poorly after growing in the first quarter of the year.

“In contrast April was a strong month for construction, research and development and retail, with increases in these only partially offsetting falls elsewhere.

UK economy shrank in April

Newsflash: The UK economy shrank in April, as companies were buffeted by Donald Trump’s trade war and higher taxes.

The latest GDP report, just released, has confirmed T.S. Eliot’s line that “April is the cruellest month”.

The economy shrank by 0.3% during April, the Office for National Statistics reports, a bigger fall than expected, and one which may fuel concerns that the economy is weakening.

April began with Donald Trump announcing large tariff increases on US trading partners, but was also the month when UK employers started paying higher national insurance contributions.

The ONS says services output fell by 0.4% in April 2025, following growth of 0.4% in March 2025, and was the largest contributor to the fall in GDP in the month.

Production output also decreased, by 0.6%, but construction output rose by 0.9% in April.

Resolution Foundation: Britain turning into a National Health State

Britain is slowly turning into a “National Health State”, as lower-income families gain most from Wednesday’s spending review.

That’s the conclusion of the Resolution Foundation, the think tank, which has been busy analysing Rachel Reeves’s announcement yesterday.

They found that health accounted for 90% of the extra public service spending announced, meaning half of public service spending is set to be on health by the end of the decade.

They also predict that Reeves may need to look at tax rises in the autumn budget, due to the “weaker economic outlook and the unfunded changes to winter fuel payments”.

Here are their key findings:

An NHS state… Yesterday’s NHS-dominated settlement continues a pattern of recent Spending Reviews, which has led to a major reshaping of the state. By the end of the decade (2028-29), the health service will account for half (49 per cent) of all day-to-day public service spending controlled by Westminster – up from a third (34 per cent) in 2009-10.

The NHS has again grabbed the lion’s share (90 per cent) of the extra funding for day-to-day public services allocated at the Spending Review,.

Spending on the rest of day-to-day public services will fall slightly (by 1.3 per cent on average) in real, per-person terms by the end… pic.twitter.com/mnwzagCrQr

— Resolution Foundation (@resfoundation) June 11, 2025

…and shrunken public services elsewhere. While real, per-person funding for health has increased by 36 per cent between 2009-10 and 2028-29, it has fallen by 16 per cent for Justice, 31 per cent for Work and Pensions, and 50 per cent for Housing, Communities and Local Government over the same period.

Defence dominates infrastructure plans while total non-defence investment sees cuts. The £9.7 billion a year increase in capital spending between 2025-26 and 2029-30 includes an increase of £5.9 billion of financial transactions (primarily loans), with around two-fifths of the Warm Homes Plan now being funded by loans rather grants. Once these financial transactions are stripped out, the £7.4 billion a year increase in defence contrasts sharply with the £3.6 billion cut to real investment across all other departments.

The rise, fall and rise again of public service spending. Real day-to-day spending is now rising again in the 2020s (2019-20 to 2028-29) by 2.2 per cent a year, following a 0.5 per cent fall per year in the 2010s (2009-10 to 2019-20). In the decade prior to that, spending rose by 4.3 on average each year (2001-02 to 2009-10).

Lower-income families get a benefits-in-kind boost. The extra funding for hospitals, schools and the police relative to plans set out by the previous Government will deliver important benefits-in-kind to families. The Foundation estimates that a middle-income household will gain £1,400 on average for extra public service provision (in 2028-29), rising to £1,7000 for the poorest fifth of families.

From a summer of spending to another autumn of tax rises? The large increase in public spending has been funded in large part by the £39.7 billion of tax rises (in 2028-29) announced in the Budget last Autumn and £3.6 billion of benefit cuts (in 2028-29) announced in the Spring Statement – equivalent to £1,550 for every family in Britain. But the combination of a weaker economic outlook, an unfunded spending commitment on Winter Fuel Payments, and just £9.9 billion of headroom against the Chancellor’s fiscal rules, mean further tax rises are likely to be needed this autumn.

House price surge over last 20 years, Zoopla report shows

Hilary Osborne

Data from Zoopla this morning has confirmed what we have all known for a while: house prices have rocketed over the past two decades. Figures from the listing site show the average price of a UK home has risen by 74% since 2005.

Its analysis of the cost of homes found the average price had gone from £154,300 in April 2005 to £268,200 in the same month of this year.

Although for a while wage increases lagged house prices, Zoopla said over the 20-year period price to earnings ratios had remained broadly the same, with properties changing hands for 6.4 times incomes.

However, the headline figures disguise big differences around the UK. In the south London borough Merton, Zoopla said prices increased by 147% over the period, from £228,600 to £563,800 – this was the biggest percentage increase in the country. In cash terms, the biggest rise was also in London, this time in Kensington & Chelsea – where the average price increased by 124% over the period, from £504,000 to £1.13m.

London boroughs took up 18 of the top 20 spots and seven recorded price growth of more than 130%. Spelthorne in Surrey was the first place outside London, with an increase of 112% from £206,800 to £439,100.

At the other end of the spectrum were several areas in the north of England which recorded growth of just 22%. In Sunderland, prices were up by 22%, going from £101,600 to £124,000. Prices in Darlington and County Durham rose by the same percentage, but by more in cash terms.

Toby Leek, president of NAEA (National Association of Estate Agents) Propertymark, says:

“Across the country, homeownership in general is becoming increasingly difficult to achieve.

Ultimately, we need additional support for first-time buyers, a review of stamp duty, and more homes to be built to keep pace with growing demand. These must be designed with amenities and infrastructure as an integral part of the process.”

Introduction: UK GDP report coming up

Good morning, and welcome to our rolling coverage of business, the financial markets, and the world economy.

We’re about to learn how the UK economy fared during “Awful April”.

The latest GDP report, due at 7am BST, will show whether or not the UK managed to keep growing during a month dominated by Donald Trump’s trade war, which also brought a jump in bills for consumers, and the rise in employer national insurance contributions.

Economists predict a slowdown – indeed, the consensus forecast among City number crunchers is that GDP fell by 0.1% in April.

That would be a disappointment, after the UK economy made a decent start to 2025, growing by 0.7% in the first quarter of the year.

Deutsche Bank predict the economy stagnated in April, with their chief UK economy Sanjay Raja explaining:

By all accounts there are likely to be some volatile swings – particularly when it comes to manufacturing. Some negative pay-back in the services sector too, we think, is very possible.

The good news? Better weather will have likely helped output in general, especially within consumer-facing services.

So far this year, the UK economy was flat in January, then grew by 0.5% in February, and by 0.2% in March.

Investors will also be digesting yesterday’s UK spending review, in which chancellor Rachel Reeves outlined billions of pounds of infrastructure spending. Health and defence were the priority, but other areas will face a tough squeeze on funding.

The agenda

7am BST: UK GDP report for April

7am BST: UK trade balance for April

1.30pm BST: US weekly jobless claims report

1.30pm BST: US PPI index of producer prices for May

Source link