This AI giant has been soaring nicely of late, and investors can expect it to step on the gas in the new year.

Palantir Technologies (PLTR 5.68%) stock is coming off another remarkable year. Shares of the artificial intelligence (AI) software specialist shot up by 143% in 2025, outperforming the broader market by a huge margin.

It is worth noting that Palantir stock has jumped by 2,800% over the past three years. However, the broader sentiment on Wall Street suggests that the stock may have gotten ahead of itself. Though the company’s growth is accelerating at a solid pace and it has a big enough revenue pipeline to maintain its momentum, the stock’s lofty valuation is a point of concern.

The company will have to continue outperforming expectations by wide margins to eventually justify its current sales multiple of 122 and earnings multiple of 435. So, if you missed out on Palantir’s stunning surge and are wary of buying it now because of its valuation, you might instead want to take a closer look at another company that has the potential to win big from the proliferation of AI in 2026 and beyond — Alphabet (GOOG +0.48%) (GOOGL +0.69%).

Image source: Alphabet.

The market may be underrating Alphabet’s AI-fueled growth potential

Alphabet’s stock gains over the past three years have been nowhere close to Palantir’s. It rose by 253% during this period, which is not surprising, given that the company initially fell behind its rivals in the AI race. However, its AI credentials have received some big boosts lately.

Today’s Change

(0.48%) $1.52

Current Price

$315.32

Key Data Points

Market Cap

$3.8T

Day’s Range

$310.67 – $322.94

52wk Range

$142.66 – $328.67

Volume

1.1M

Avg Vol

23M

Gross Margin

59.18%

Dividend Yield

0.26%

Alphabet may have stumbled initially, but its steady approach to the new tech is reaping dividends. This is evident from data provided by web analytics platform Similarweb, which points out that Alphabet’s Google Gemini chatbot now controls 18% of generative AI web traffic, more than triple its share from the year-ago period.

The generative AI assistant has made that impressive growth at the expense of OpenAI’s ChatGPT, which has seen its market share slide by 19 percentage points from 87% to 68%. Alphabet’s growing share of this space isn’t surprising. The company has integrated Gemini across different applications, including its Chrome browser, its Android smartphone operating system, its Google Search engine, and the Google Workplace productivity tools.

The company has been monetizing Gemini by offering various subscription tiers that enable users to deploy the AI assistant for generating images, creating videos, carrying out research and writing tasks, and utilizing Gemini in Gmail, Docs, and other applications. Given that Gemini is a consumer-facing app that helps users boost productivity, it could eventually allow Alphabet to make a bigger dent in the AI software market.

ABI Research estimates that the AI software market could grow from $122 billion in 2024 to $467 billion in 2030. Alphabet, therefore, seems poised to capitalize on a massive opportunity that could help accelerate its long-term growth. Research firm Pivotal Research estimates that Gemini’s prospects could send Alphabet stock to $400, which would be a jump of 27% from current levels. However, the long-term opportunities in AI software and other AI-related catalysts that Alphabet is sitting on could help it easily surpass that mark.

This move could supercharge Alphabet’s growth

There are reports that Alphabet is considering selling some of its Tensor Processing Units (TPU) — the custom AI chips that it developed in-house — to third parties. AI company Anthropic said in October that it plans “to expand our use of Google Cloud technologies, including up to one million TPUs, dramatically increasing our compute resources as we continue to push the boundaries of AI research and product development.”

Anthropic added that it will spend “tens of billions of dollars” on this expansion, bringing more than 1 gigawatt of AI computing capacity online in 2026. This news was followed by a report in November that Meta Platforms is looking to spend billions of dollars purchasing Alphabet’s TPUs. Thus far, Alphabet has only deployed TPUs in its own cloud servers.

Analyst Gil Luria of financial services company D.A. Davidson says that if Alphabet decides to sell its TPUs to third parties, it could corner a fifth of the AI chip market in the long run. That could translate into a $900 billion revenue opportunity for the company.

Given that Alphabet has generated just over $385 billion in revenue in the trailing 12 months, the potential opportunities discussed above indicate that it can significantly increase its top line in the long run. Throw in the terrific growth of its Google Cloud business and the huge backlog in this segment, and it is easy to see why analysts have become bullish about Alphabet’s prospects.

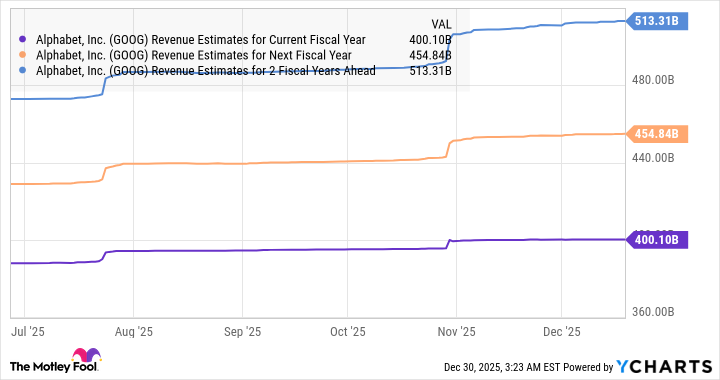

GOOG Revenue Estimates for Current Fiscal Year data by YCharts.

As such, there is a good chance that Alphabet stock will sustain its newly found momentum in 2026. The stock has jumped by more than 76% in the past six months, and it can still be bought at an attractive 10 times sales and 28 times forward earnings — multiples that are significantly cheaper than Palantir’s. However, Alphabet may not trade at such attractive valuations for long. It could soon be rewarded with richer multiples because of its accelerating growth, en route to further upside in this AI stock in 2026 and beyond.