Mutual funds have become increasingly selective in their IPO participation in 2025, a sharp contrast to their earlier aggressive stance. A bl.portfolio study shows their involvement dropped from 96% in 2021 to 68% up to July 2025.

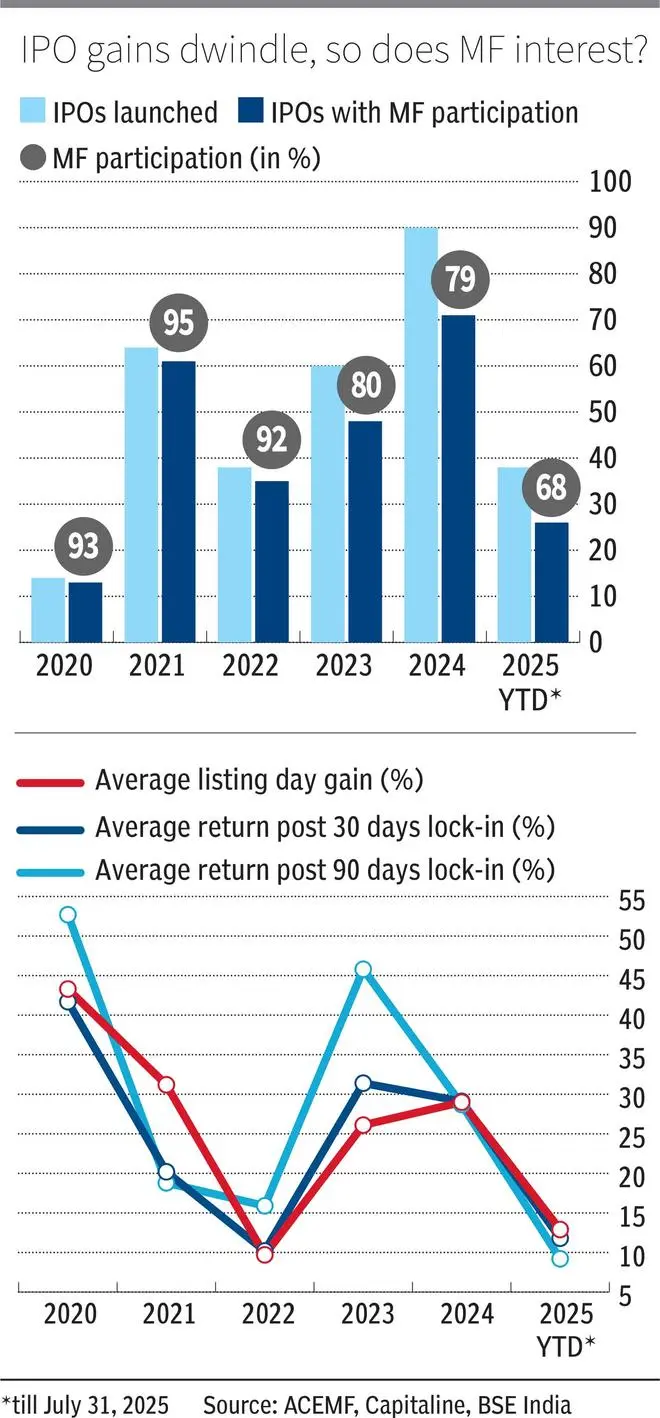

Mutual funds have turned increasingly selective in IPO allocations in 2025, a shift from their earlier aggressive stance. A bl.portfolio study shows the proportion of IPOs where funds took part, either as anchor investors or through post-listing buys, has fallen from 96 per cent in 2021 to 68 per cent year to date up to July 31.

Mutual funds invest in IPOs either through main book allocations (anchor and non-anchor portions) or via secondary market purchases post-listing. Due to limited visibility on non-anchor allocations, this study uses month-end MF disclosures to capture first-month holdings in 304 IPOs between CY2020 and CY2025 YTD.

Small isn’t beautiful

SIPs now bring in ₹25,000 crore a month and MF assets keep swelling, so why the selective stance on IPOs? The answer lies in the surge of smaller issues with inadequate market capitalisation (m-cap).

Bharat Lahoti, Co-Head, Factor Investing, Edelweiss MF, says: “Many recent IPOs have been small, with m-cap below ₹1,000 crore, making it difficult for mutual funds to build meaningful positions. Typically, funds need a free-float m-cap of at least ₹2,000-3,000 crore to justify allocation.” In fact, 33 per cent of the 38 IPOs launched till July 2025 had m-cap below ₹2,000 crore.

Mutual funds avoided offerings such as Shanti Gold (₹1,652 crore), Arisinfra Solutions (₹1,411 crore) and Stallion India (₹999 crore). On the other hand, stocks with higher m-cap such as HDB Financial (₹69,758 crore), Hexaware (₹46,419 crore) and Anthem Biosciences (₹41,017 crore) drew strong MF interest, with 58, 56, and 81 schemes, respectively, participating during the IPO period.

Meanwhile, stocks with sizeable market-cap but moderate MF participation included NSDL (₹18,720 crore), Schloss Bangalore (₹14,546 crore), and Dr Agarwal’s Health (₹12,684 crore), which attracted 22, 26, and 14 schemes, respectively.

Investment decisions are not just about valuations. Funds also check if an IPO fits their investment mandate, sector preference and whether the issue is large enough for meaningful allocations. MF assets have nearly tripled, from ₹27 lakh crore in July 2020 to ₹75 lakh crore in July 2025. When funds were smaller, they could enter modest IPOs. Today, 42 equity schemes each manage over ₹30,000 crore. For them, even a 1 per cent exposure means ₹300 crore, effectively forcing an over-sized position that funds avoid.

Valuation check

IPO markets move in cycles. Early phases offer attractive valuations, but as cycles mature, they stretch, reducing participation, Lahoti explains. Activity also flattens during downturns, as seen in January-March 2025. With the current favourable phase expected to last another 3-6 months, valuations could eventually reach frothy levels similar to those of 2021 and 2024, he adds.

Deepak Jasani, market veteran and former Head of Retail Research at HDFC Securities, feels, “it (selective IPO participation) could also signal that their overall experience with IPOs in recent years has not been very encouraging.” Indeed, returns from IPOs launched since 2023 show that only 1 in 6 turned into wealth multiplier for mutual funds. While winners included IREDA (+365 per cent), Netweb Tech. (+310 per cent), and KRN Heat Exchanger (+308 per cent), prominent laggards included Popular Vehicles (-60 per cent), Credo Brands (-56 per cent), and ESAF SFB (- 50 per cent).

IPOs’ listing-day as well as post 30-day and 90-day lock-in gains look far from encouraging, with average listing gains at just 12.9 per cent (YTD2025). This is a sharp decline from healthy gains of, for instance, 29 per cent (2024) and 43.3 per cent (2020). Post lock-in returns also remain subdued, averaging 11.8 per cent after 30 days and only 9.2 per cent after 90. Anchor investors face a 30-day lock-in for half their allotment, with the rest locked for 90.

Yet, SEBI’s 2024 study shows MFs sold barely 3.3 per cent within a week of listing and exited less than one-third even after a year, highlighting their role as long-term investors.

Published on August 30, 2025