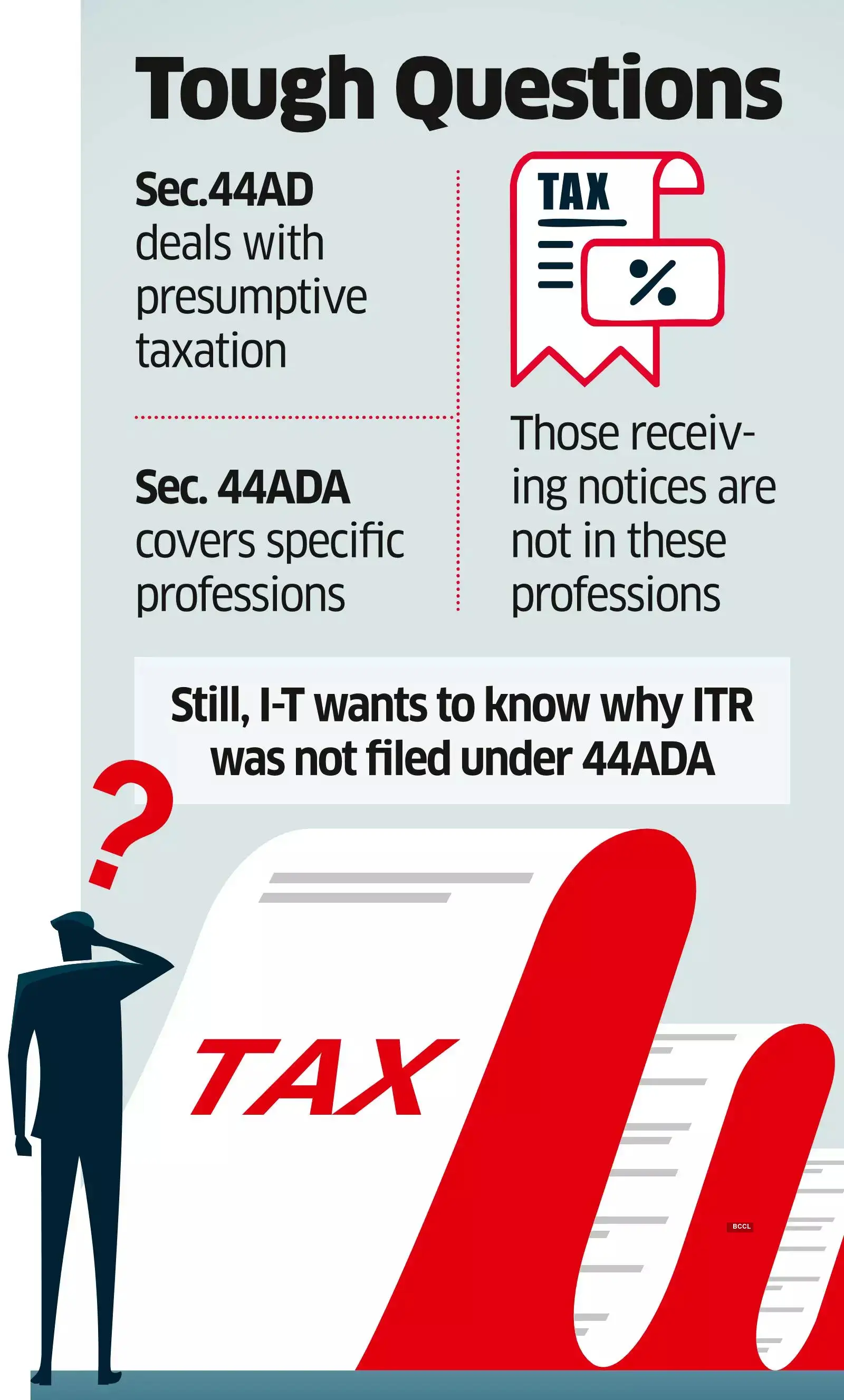

Some of them have been questioned by the Income-tax (I-T) department for filing returns under a section of the law that in most cases allows a lower tax outgo.

In the scrutiny notices they have received, the tax department pointed out that they should have filed under Section 44ADA of the I-T Act-meant for select professionals-and not under 44AD which offers a simplified presumptive tax window.

However, the dilemma before these taxpayers is that they do not qualify under the list of professionals (specified in the law) who are eligible to pay tax and file returns under 44ADA.

These specified professionals, provided in Section 44AA, include persons engaged in legal, medical, engineering, architectural, technical consultancy, interior decoration, film artist, authorised representative, chartered accountants, company secretary, and professionals in the information technology sector.

So, it’s commonly understood that persons in professions outside this list come under Section 44AD. Resident individuals, Hindu undivided families (HUF), and partnerships (excluding limited liability partnerships) are covered under Section 44AD as long as the persons are not in the list of professions listed under Section 44AA (for whom 44ADA would apply).

Persons not preparing books of accounts and claiming no deduction can pay I-T on 6-8% of their gross receipts, as per Section 44AD -a relief to businesses persons with turnover below ₹2 crore. Typically, in keeping with the language of the law and to avoid being pulled up by tax authorities, most Section 44AD assesses pay tax on the balance income after deducting certain expenses.

Under Section 44ADA, professionals (in the specified list) report their taxable income at 50% of gross receipts if their income from the activity is within ₹75 lakh.

Practitioners said the reason professionals and consultants who have filed ITR under Section 44AD -and are now being asked why they had not filed under Section 44ADA -is because the tax office software has picked their cases for scrutiny on how their clients had paid the tax deducted at source (TDS). Their customers and clients have deducted 10% TDS under Section 194J -consciously choosing a higher TDS rate when they could have deducted 2% TDS under a different section (194C) -to keep tax officials at bay.

“The fact that tax has been deducted under a specific provision (Section 194J), and the income has not been declared under Section 44ADA, should not, by itself, form the basis for selecting cases for scrutiny. TDS under Section 194J does not, in itself, make an assessee eligible for taxation under Section 44ADA. The benefit under Section 44ADA is strictly limited to professions specified under Section 44AA(1). Notably, certain professions, such as those related to sports, may fall under the ambit of Section 194J without being classified as professions under Section 44AA, hence, outside the scope of Section 44ADA,” said Ashish Karundia, founder of the CA firm Ashish Karundia & Co.

The Supreme Court, he said, has consistently interpreted the term ‘business’ in a broad sense, extending beyond mere trade or manufacturing. It encompasses professions, vocations, and callings, recognising activities that are carried out continuously and systematically with the application of skill and effort to earn income. Thus, unless a person is engaged in a profession specifically listed under Section 44AA(1), or derives income from commission or brokerage, or operates an agency business, the presumptive taxation scheme under Section 44AD remains accessible and is not restricted, said Karundia.

Those receiving such notices should carefully examine the true nature of their activities-whether they fall under “business” or “profession” as defined in the Income-tax Act, according to Paras Savla, a CA.

“If their work is genuinely in the nature of business (not professional services notified under section 44AA), they can respond with proper documentation to justify their filing under 44AD. Merely the fact that TDS was deducted under section 194J does not automatically mean the income is “professional income.” Further, if the taxpayer’s activity is closer to a business contract (not a professional service), clients may deduct TDS under 194C instead of 194J to avoid mismatches. However, shifting to 194C could create compliance issues for clients as the department often scrutinises such reclassification. Clients will want to ensure the arrangement is defensible as a ‘contract’ rather than a ‘professional service'”, said Savla.