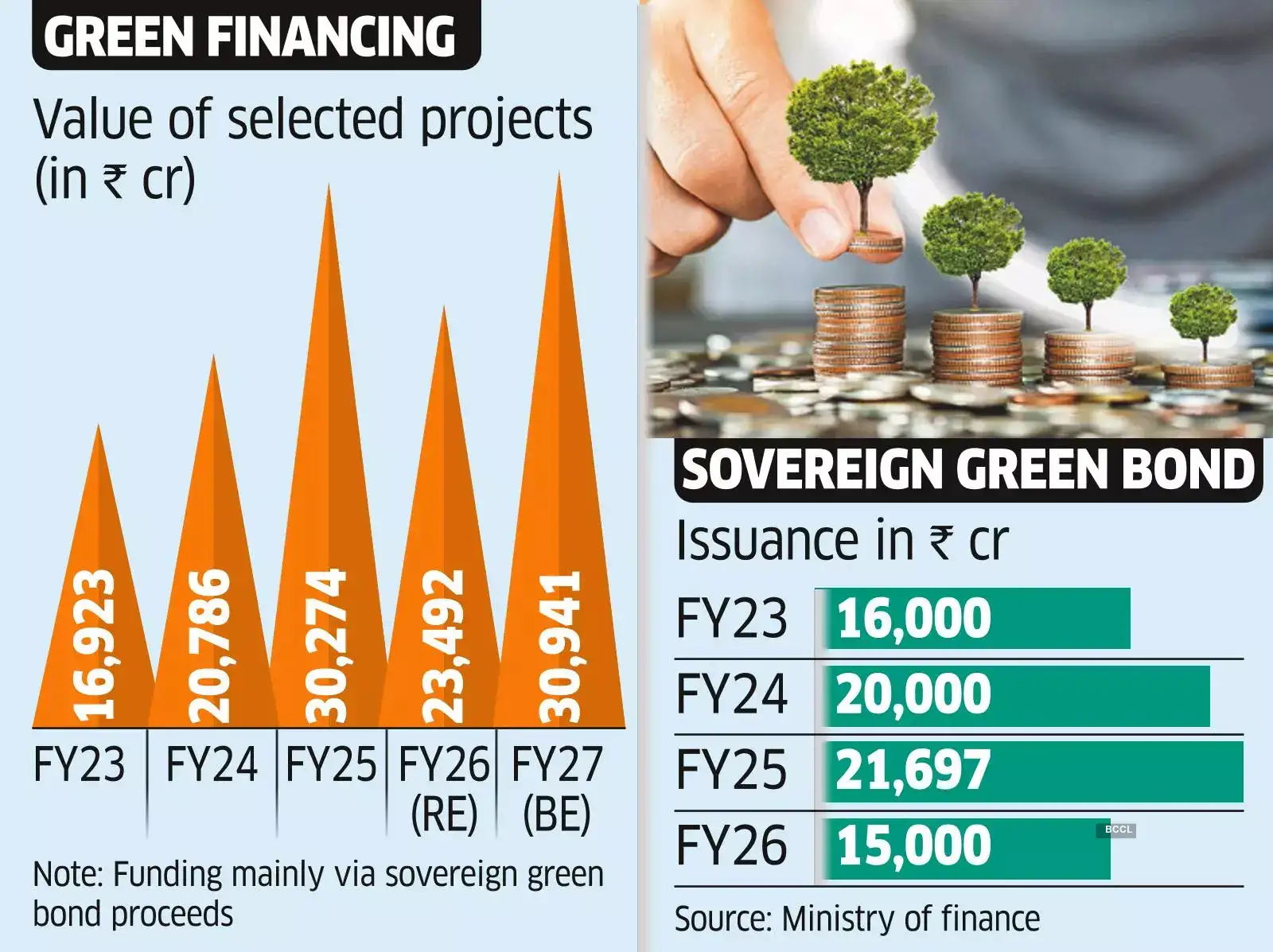

Projects worth ₹31,000 crore to be funded mainly via green bonds in FY27

The Centre will decide the precise amount of the sovereign green bond float in financial year 2027 in March when it finalises its borrowing plan for the next fiscal, but usually the project pipeline is readied for such funding well before.

However, the funding requirement for the earmarked projects influences the size of the bond issue. The government finances these projects through its general resource mop-up if green bond proceeds fall short.

The government aims to garner ₹15,000 crore via green bonds this fiscal year. New and renewable energy projects worth ₹11,700 crore have been identified for green funding in FY27, more than four times of just ₹2,500 crore this fiscal. Railways remain the top contender for such funds, as it has identified projects worth ₹15,000 crore for green financing. Separately, metro rail projects worth ₹4,069 crore are proposed to be funded by green bonds, according to the spending plans firmed up by the finance ministry. The projects, identified by relevant departments and ministries, are assessed by a team led by the chief economic advisor before approval for green finances.

Rlys remains biggest green bond beneficiary with ₹15,000 cr projects

Sovereign green bonds debuted in FY23 to signal India deepening its green financing market. It was part of the broader efforts to reduce the country’s carbon footprint and contribute to its ambitious 2070 net zero emissions target.

Low ‘greenium’

From FY23, the government would be raising ₹72,697 crore through green bonds till the end of this fiscal. But the papers have barely attracted the so-called “greenium”-the premium over the borrowing cost of similar non-green instruments-that it expected. In fact, the greenium has been negligible, ET has learnt. This is a disincentive for the government, which must deploy resources to ensure that the proceeds raised via this route are spent strictly on green projects.

To be sure, the government’s overall annual budgetary spending on green projects across sectors would far exceed this level. But such expenditures are not strictly segregated and classified as per the environment-friendly nature of the projects. However, since the government tapped green bonds to raise funds in FY23, it had to formally identify certain green projects to be funded by such proceeds.