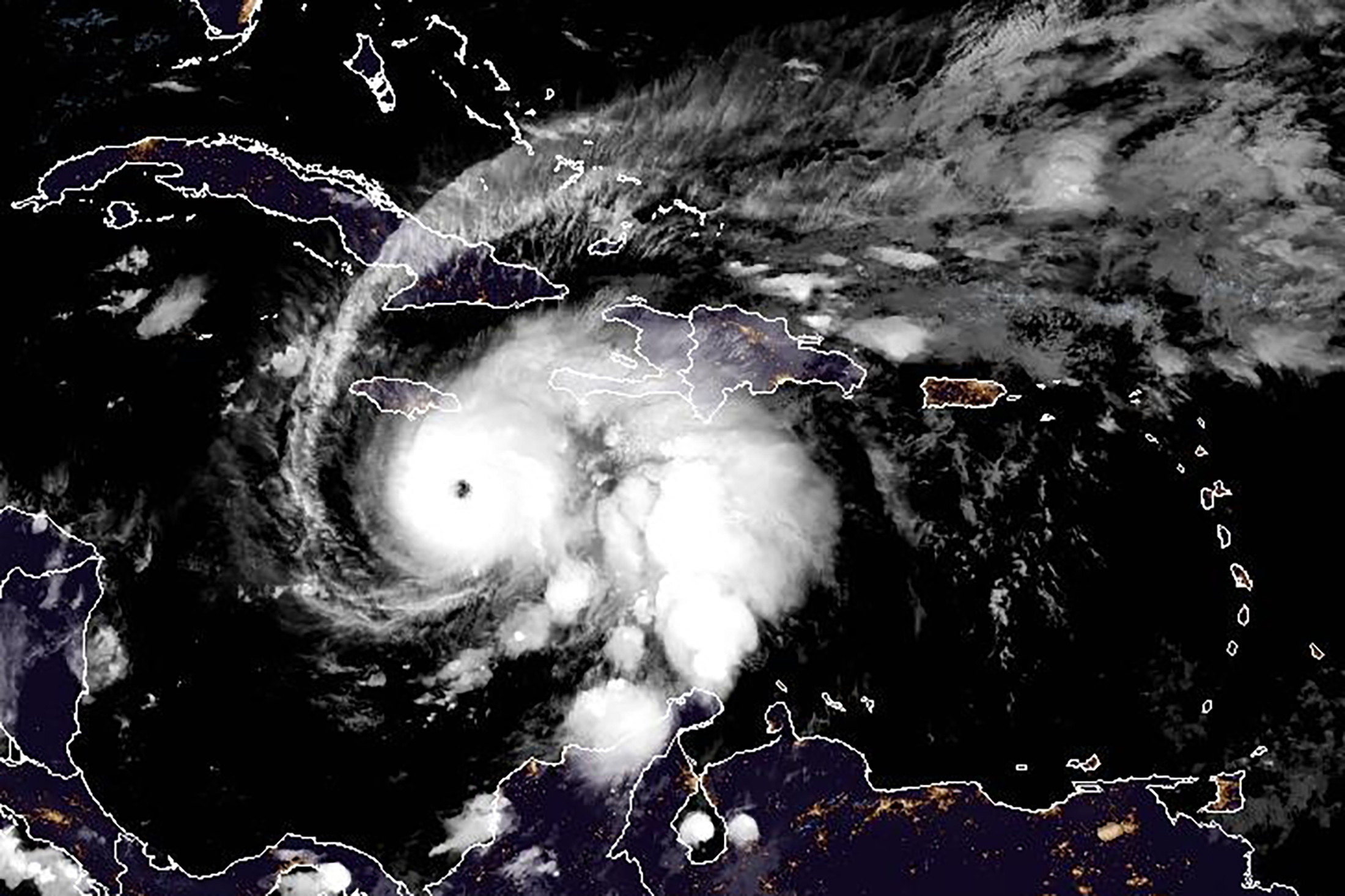

Hurricane Melissa made landfall in Jamaica as a powerful category 5 storm – a record for the Caribbean island nation — which brought storm surge, torrential rain, strong winds and massive damages.

Melissa made landfall near New Hope, Jamaica, at 1 p.m. EDT on Tuesday with maximum sustained winds of 185 mph, according to a report from AccuWeather. Today, the storm is lashing Cuba and heading toward the Bahamas and perhaps Bermuda, the weather service said.

While it will take days to ascertain the extent of damages, economic losses in Jamaica are expected to hit $22 billion, AccuWeather estimated.

Cotality, the property intelligence company, estimates economic damages in Jamaica from Hurricane Melissa could range between $5 billion and $10 billion. “A direct Category 5 landfall on the nation’s most populous corridor could significantly strain public finances for years to come,” Cotality said. (Economic damages include insured losses).

Hurricane Melissa has made meteorological history for a number of reasons. In addition to being the first category 5 storm to hit Jamaica (with winds of 185 mph), it also is the first storm of this strength for the 2025 hurricane season. “The last category 5 to hit a Caribbean island was Hurricane Dorian when it hit the northwestern Bahamas on Sept. 19, 2019,” said AM Best, noting that this is the first hurricane to make landfall in Jamaica since category 4 Hurricane Gilbert in 1988.

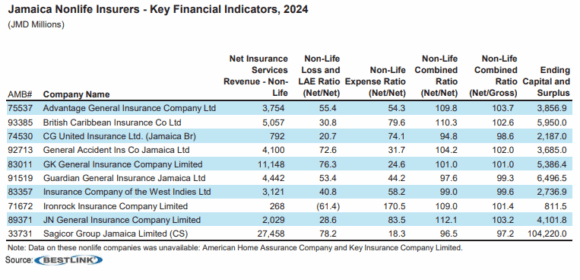

As for insured losses, ratings agency AM Best explained that Jamaica’s insurance penetration is low with less than 5% of property covered by insurance.

“There are several local insurers that will be impacted by this storm, but as is the norm for the Caribbean islands, insurers there rely heavily on reinsurers,” said AM Best in a report titled “Jamaica’s Insured Losses From Hurricane Melissa Likely to Fall to Reinsurers.”

“Reinsurance partnerships are the cornerstone that provides the capacity for insurers to profitably write property business in the Caribbean, especially in catastrophe-affected years,” the report added.

“It remains to be seen how this event will affect reinsurance pricing going forward. It’s also likely that a $150 million Jamaican parametric cat bond – IBRD CAR Jamaica 2024 – will trigger. This is part of the World Bank’s catastrophe risk insurance program for the region,” the AM Best report said.

Cotality said that reinsurance and capital-markets capacity will be tested.

“Pricing on Jamaica’s $150 million World Bank-sponsored IBRD CAR Jamaica 2024 catastrophe bond has dropped as investors brace for a possible trigger once official wind or pressure readings are finalized,” Cotality affirmed.

“Local insurers retain higher deductibles than before the recent hard market, yet international reinsurers still hold the lion’s share of property-catastrophe exposure,” it continued. “A multi-billion-dollar insured loss, even a mid-single-digit figure in absolute terms, could represent one of the most concentrated reinsurance events ever seen in the Caribbean and could pierce several aggregate covers.”

At the end of 2024, there were 17 registered general and life insurance companies domiciled in Jamaica, said AM Best, quoting Jamaica’s Financial Services Commission.

AM Best said these types of natural catastrophes highlight the need to build awareness of the protection that insurance can provide across the Caribbean region.

“While facilities such as the Caribbean Catastrophe Risk Insurance Facility have provided some economic relief to the governments of member countries, which includes Jamaica, a combination of macro-initiatives and microinsurance may have greater potential in narrowing the region’s protection gap,” the report continued.

However, AM Best highlighted the problem of catastrophe models in the Caribbean, which are generally not as robust as the ones used to model U.S. hurricanes.

Part of the challenge is that there are “disparate building codes and data quality,” the report noted.

“Models need to consider the correlation of events between geographies in the region as catastrophe risk can potentially be spread across the entirety of the Caribbean.”

Topics

Catastrophe

Natural Disasters

Reinsurance

Hurricane

Property

AM Best

Interested in Catastrophe?

Get automatic alerts for this topic.