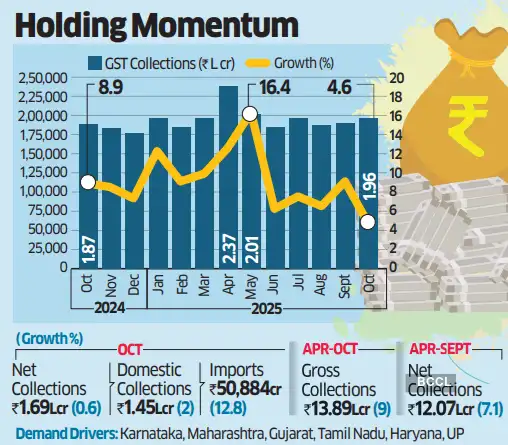

Data published on Saturday showed indirect tax revenues edged up despite the Centre’s decision to largely abolish a cess and lower taxes from September 22 on 99% of regular goods and services. Collections overshadowed the impact of a 40% growth in GST refunds through the month.

“The fact that the GST collections have grown, though marginally, with significantly reduced rates indicates that consumption remains robust, as borne out by other economic indicators as well,” said MS Mani, tax partner at Deloitte India. He said abolition of levy on two-wheelers, cars, air-conditioners and television sets reduced the quantum of incident tax on these items that saw robust consumption demand.

Similar Trend in Nov

Karnataka, Maharashtra, Gujarat, Tamil Nadu, Haryana and Uttar Pradesh were at the vanguard of demand growth through the month.

“October GST data would affirm that India’s growth story is both broadening and deepening, founded on robust local demand, rising industrial momentum, and sustained fiscal resilience in a challenging global environment,” Manoj Mishra, tax partner at Grant Thornton Bharat.

Top Gear

Early retail indicators show broadbased demand across autos, fast-moving consumer goods (FMCG), apparel and electronics, reflecting renewed consumer confidence, Mishra said.

Gross import collections stood at ₹50,884 crore, up 12.84%.“Higher gross GST collections reflect a strong festive season, higher demand and a rate structure that has been well absorbed by businesses,” said Abhishek Jain, indirect tax head and partner, KPMG.

November collections should also show similar trends.

Collections, however, are anticipated to soften from December onward, when festival-driven consumption slows.

That run rate should show the full impact of GST rate rationalisation on both collection and consumption, a run rate expected to be keenly tracked both by the Centre and economists.

Through the month, the Centre issued ₹26,934 crore as refunds, 40% higher than last year.

“A consistent increase in GST refunds (domestic as well as exports) shows confidence of tax administration that GST collections would show positive trend in the future as well,” said Pratik Jain, partner at PwC LLP.

The collection net of refunds stood at ₹1.69 lakh crore, up 0.6%, against the same period last year.

“Crucially, the government’s unwavering commitment to resolve working capital issues for exporters and address concerns around the inverted duty structure are significant positive developments,” said Saurabh Agarwal, tax partner at EY India.

Agarwal added that certainty in the tax regime and reduction of working capital leakages are vital confidence boosters for the investor community, reinforcing India’s ease of doing business credentials.