Markets brace for US jobs report, after explosive Trump-Musk row

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Investors will have one eye on the US jobs market today, and the other on the spectacular blow-up between Donald Trump and Elon Musk overnight.

The latest US employment report is expected to show a slowdown in hiring across the US in May.

Economists forecast that the US non-farm payroll will have risen by around 130,000 in May, down from the 177,000 increase recorded in April, with the unemployment rate sticking at 4.2%.

A weak payrolls report could fuel fears that the US economy is slowing, as Trump’s trade wars hit activity. But it could also intensify the pressure on the US Federal Reserve to lower interest rates, something the US president has been demanding for months.

Tony Sycamore, market analyst at IG, explains:

The US unemployment rate has hovered between 4.0% and 4.2% over the past year, and a job in the unemployment rate to 4.3% or higher will heighten economic slowdown fears. The US rates market is pricing in an 85% chance of a 25bp Fed rate cut in September, with a cumulative 55bp in cuts expected by year-end.

So the markets could be volatile at 1.30pm UK time, when the non-farm payroll data lands.

Speaking of volatility… the Trump-Musk relationship exploded dramatically on Thursday, with the president and the world’s richest person slinging accusations at each other.

Shares in Tesla slumped over 14%, wiping over $150bn off the company’s value, as Trump threatened to terminate Musk’s governmental subsidies and contracts, and accused the billionaire of going “CRAZY!” over the removal of electric car subsidies.

From the other corner, Musk called for Trump’s impeachment, claimed the president appeared in the files into convicted sex offender Jeffrey Epstein, and briefly threatened to decommission SpaceX’s Dragon spacecraft.

It all added up to another bruising day for shareholders in Tesla, whose value had already been hit by the backlack against Musk’s role in the Trump Administration.

Some traders will have been betting on further falls in Tesla’s share price, as Chris Weston, head of research at Pepperstone, explains:

The selling in Tesla stock on the day has been wholly impressive with 285m shares traded on the day – the most since Jan 2023 – with a ‘sell first, ask questions later’ mentality sweeping through the shareholder base.

In the options space, over 4m put options traded hands, 4x the 20-day average.

The agenda

-

7am BST: Halifax house price index

-

9am BST: UN FAO food price index

-

10am BST: Eurozone GDP report for Q1 2025 (3rd estimate)

-

11.30am BST: Bank of Russia interest rate decision

-

1.30pm BST: US non-farm payroll report

Key events

US jobs report approaches….

Tension is building in the financial markets as investors await the latest US jobs report, due in under half an hour’s time.

As flagged in the introduction, economists expect a hiring slowdown – with non-farm payrolls forecast to increase by around 130,000 for last month, down from 177k in April.

But as usual, there’s a wide range of forecasts – from a low of 75,000 new jobs to a high of 190k.

US May Payrolls Seen Slowing Sharply, Keeping Fed on Cautious Path

Friday’s US non-farm payrolls (NFP) report will conclude a volatile week, during which US President Donald Trump’s import tariffs dominated headlines and drove moves in global equity markets.

Economists expect… pic.twitter.com/6o9VTq0g1r

— LiveSquawk (@LiveSquawk) June 6, 2025

The unemployment rate is expected to remain steady at 4.2%.

Kathleen Brooks, research director at XTB, explains:

The US economy needs to create approximately 200k jobs per month for the unemployment rate to remain stable, likewise, initial jobless claims need to stay below 260k-270k per week for the unemployment rate not to rise. The question is, will job growth slow to such an extent that the unemployment rate rises? The consensus is no, not yet. It is worth considering the economic backdrop, to determine if a downside surprise in the labour market data could materialise on Friday. Consumer sentiment has picked up in recent weeks, although it remains at low levels, business confidence has also picked up from the lows, and the layoff rate, as calculated by the Jolts survey, remains stable.

Thus, while we expect a soft May payrolls report, we do not think that it will show the labour market falling off a cliff. The de-escalation in the US/ China trade war may have helped sentiment. There remains a huge amount of uncertainty caused by the US trade tariffs, and if the US economy can generate decent jobs growth in this environment it would suggest an underlying resilience, which could boost stock markets, the dollar and overall risk sentiment.

Anything under 100k for May payrolls would be considered weak, and it may also be a sign of worse to come. Thus, Friday’s report is all about the trajectory of the US labour market and what this means for the Federal Reserve.

NatWest banking app is down

UK bank NatWest has apologised to customers after service issues left people unable to log in to their mobile app.

Customers are being urged to use online or telephone banking, or go into a branch, while it works to fix the problem.

A spokeswoman for the bank said:

“We are aware that customers are experiencing difficulties accessing the NatWest mobile banking app this morning.

“We’re really sorry about this and working to fix it as quickly as possible.

“Customers can still use online and telephone banking, or visit a branch.”

More than 3,000 outages were reported through services monitoring site Downdetector at about 10am on Friday.

UK proposes lifting ban on bitcoin and crypto funds

Britain’s financial regulator is clearing the way for UK investors to buy crypto assets such as bitcoin though low-cost ETF-style funds.

The Financial Conduct Authority is proposing to lift the ban on offering crypto exchange traded notes (cETNs) to retail investors.

The change would mean that cETNs could be sold to individual consumers, rather than just professional investors, in the UK, if they’re traded on an FCA-approved investment exchange.

The FCA notes that similar products are already available in other countries.

David Geale, executive director of payments and digital assets at the FCA said:

“This consultation demonstrates our commitment to supporting the growth and competitiveness of the UK’s crypto industry. We want to rebalance our approach to risk and lifting the ban would allow people to make the choice on whether such a high-risk investment is right for them given they could lose all their money.”

This feels like a change of position from the regulator, which has previously warned that crypto investors should be prepared to lose all their money

The UK boss of Tata Steet is urging the British government to secure its trade deal with Donald Trump as soon as possible, amid fears it could miss out on tariff-free access to the US.

It was reported yesterday that Tata Steel, which runs the vast Port Talbot steelworks in south Wales, could breach US import rules that require all steel to be “melted and poured” in the country from which it is imported.

That’s because Tata is curently importing steel from its sister companies in India and Europe to be finished in the UK, having shut down its blast furnace at Port Talbot last year as it shifts to a greener electric arc furnace.

Rajesh Nair, CEO of Tata Steel UK says today:

“We are grateful for the work the UK Government has undertaken so far in negotiating this trade agreement with the US administration.

“Tata Steel UK will need to import steel substrate until Electric Arc Furnace steelmaking is operational in Port Talbot from late 2027 onwards. It is therefore critical for our business that melted and poured in the UK is not a requirement to access the steel quotas in any future trade deal.

“Even though we are not currently melting steel in the UK, we remain the largest steel producer in the country and our mills continue to transform imported steel coil and slab into high-value, specialist products which are not available from US producers and are therefore essential to our US customers.

“We urge the government to secure a deal as soon as possible, and we would be happy to provide the US Government with any needed assurances on the provenance and processing of the steel we supply.

“However, a good deal with the US will not negate the need for an urgent review of the UK’s own tariff rate quotas for steel to protect us from re-diverted steel flows and global overcapacity”.

Silver price hits 13-year high

The price of silver has hit a 13-year high this morning.

Silver traded as high as $36.29 per ounce, its highest level since February 2012.

Achilleas Georgolopoulos, senior market analyst at Trading Point, suggests anxiety over the US-China dispute over rare earth minerals could be lifting the silver price:

Silver is stealing the limelight, as, at the time of writing, it is trading above the $36 level, recording a new 13-year high.

Some investors believe that this move could be an indication of a brighter economic outlook, given silver’s multiple industrial uses. While that could be the case, the current upleg could also be driven by hoarding amidst the ongoing rare earth metals dispute.

As well as being a precious metal, silver also has industrial uses, in electronics, automobile components and solar panels.

Another factor may be some investors shifting out of gold into silver, which has hit a series of record highs in the last few years.

Alexander Zumpfe, a senior trader at German gold refiner Heraeus Group, told Bloomberg yesterday that there was “renewed interest from momentum-driven investors who are rotating into silver.”

Zumpfe explained:

“After lagging behind gold for several weeks, silver is now catching up,”

The weakness of the dollar has also pushed up the prices of precious metals quoted in the US currency.

Eurozone growth revised up to 0.6% in Q1 2025

Newsflash: the eurozone economy grew faster than previously estimated.

Eurozone GDP rose by 0.6% in January-March, new data from eurostat shows, twice as fast as the 0.3% growth previously estimated.

The increase has been driven by Ireland, whose economy expanded by a sizzling 9.7% in the last quarter, due to a surge of exports of products, such as pharmaceuticals, to avoid new US tariffs.

Ireland was followed by Malta (+2.1%) and Cyprus (+1.3%). The highest decreases were observed in Luxembourg (-1.0%), Slovenia (-0.8%), Denmark and Portugal (both -0.5%).

Germany expanded by 0.4%, and France by 0.1%, slower than the UK which expanded by 0.7% in the quarter.

The owner of Pret A Manger is reportedly considering selling a stake in the sandwich chain ahead of a potential stock market flotation.

Luxembourg-based JAB Holding – which bought Pret for £1.5 billion in 2018 – told the Financial Times that while it was not “currently” considering a stake sale in Pret, it could look at the move with an initial public offering (IPO) in its sights.

“As we move closer to a potential IPO, we may evaluate bringing on a pre-IPO investor,” it told the FT.

It is thought to mark the first time Pret has publicly confirmed IPO plans for Pret, PA Media reports.

Wall Street is set to open higher in a few hours time, after falling yesterday amid the clashes between Elon Musk and Donald Trump.

The S&P 500 share index, which fell 0.5% yesterday, is up around 0.35% in premarket trading.

Tesla shares are up over 4% in premarket trading, recovering a portion of yesterday’s 14% tumble.

There could be hopes that the two men patch up their disagreement; overnight, hedge-fund billionaire Bill Ackman urged Trump and Musk to stop fighting and “make peace” for the benefit of the US.

I support @realDonaldTrump and @elonmusk and they should make peace for the benefit of our great country.

We are much stronger together than apart.

— Bill Ackman (@BillAckman) June 5, 2025

Ion Jauregui, analyst at ActivTrades, says:

After a session marked by a sharp decline, Tesla shares rebounded strongly in after-hours trading. The catalyst: a Politico report revealing that President Donald Trump’s advisors have scheduled a phone call with Elon Musk for today, Friday, in an effort to ease tensions following a public dispute between the two figures.

Global food prices fell in May

Global food commodity prices declined in May, driven by cheaper cereal, sugar, and vegetable oil prices.

The United Nations’ Food and Agriculture Organization has reported that its food price index, which tracks a basket of food commodities, dipped by 1 point last month, to 127.7 points. That left prices 7.2% higher than a year ago, but almost a third below its peak in March 2022 after Russia’s invasion of Ukraine.

Cereal prices fell 1.8%, thanks to a record maize harvest in the US, and increasing seasonal availability from ongoing harvests in Argentina and Brazil.

Vegetable oil prices fell 3.7%, with palm, rapeseed, soy and sunflower oil prices all down.

Sugar fell 2.6%, attributed to “weaker global demand for sugar, amid concerns over the uncertain global economic outlook and its potential impact on demand from the beverage and food processing industries”.

Meat, though, rose 1.3%, helped by strong global import demand, particularly from China, the Middle East and Europe.

Dairy prices rose 0.8%, with international butter prices remaining at “historically high levels”, due to strong demand from Asia and the Middle East amid tightening milk supplies in Australia.

Leeds technology firm Filtronic appears to be caught in the crossfire between Elon Musk and Donald Trump.

Filtronic, which was founded by Professor David Rhodes, chair of electronic and electrical engineering at Leeds University, designs and manufacturers RF-to-mmWave components. They convert radio frequency signals to higher-frequency millimeter wave signals, which allow faster communication.

It has secured several deals with SpaceX in the past, including a $20m tie-up in February to supply parts to its Starlink satellite system.

Shares in Filtronic have dropped by 10% this morning, as traders digest Trump’s threat to terminate the governmental subsidies and contracts given to Musk’s businesses.

Filtronic has been on an excellent run, though. It ended trading last night at a record high, having risen from 11p a decade ago to 132p this morning.

The London stock market has opened higher, heading back towards its recent record high.

The FTSE 100 index of blue-chip shares has gained 19 points, or 0.2%, in early trading to 8830 points.

Trade war anxiety has eased slightly, after Donald Trump and Xi Jinping held a call yesterday.

The Footsie is now less than one hundred points away from its alltime high, 8,908 points, reached in March.

Disappointing economic data from Germany this morning has suggested that the Trump trade wars have hurt Europe’s largest economy .

German exports sank by 1.7% in April, new data from statistics body Destatis shows, a bigger fall than expected.

Industrial output also weakened, falling by 1.4% month-on-month in April.

ING haven’t given up hope for a cyclical rebound in Germany, yet, anyway. Their global head of macro, Carsten Brzeski, told clients that the ongoing trade tensions will still weigh on German (and European) industry, adding:

The recently increased US tariffs on steel, along with the threat of tariffs on pharmaceuticals, highlight that the risk of escalating trade tensions remains very much alive. Compounding these pressures, the stronger euro effectively acts as an additional tariff.

And there are more potential impediments to German industry which have nothing to do with tariffs; water levels in Germany’s rivers are currently at almost unprecedentedly low levels for this time of year. Vessels can currently only transport around 50% of their normal cargo.

Bosses’ bonuses banned at six water companies

Sandra Laville

Bonuses for 10 water company executives in England, including the boss of Thames Water, will be banned with immediate effect over serious sewage pollution, as part of new powers brought in by the Labour government.

The top executives of six water companies who have overseen the most serious pollution events will not receive performance rewards this year, the environment said.

The companies – Thames Water, Anglian Water, Southern Water, United Utilities, Wessex Water and Yorkshire Water – are responsible for the most serious category of sewage pollution into rivers and seas, all of which are, or have been, under criminal investigation by the Environment Agency.

Under powers in Labour’s Water (Special Measures) Act 2025, the regulator, Ofwat, is now able to ban bonuses for water executives where a company fails to meet key standards on environmental and financial performance, or is convicted of a criminal offence.

House prices: what the experts say

Here’s some early reaction to the news that UK house prices dipped by 0.4% last month.

Tom Bill, head of UK residential research at estate agent Knight Frank:

“Demand was frontloaded this year thanks to April’s stamp duty deadline, which means house prices are coming under downwards pressure as buyers still in the market have a lot to choose from.

While activity will eventually pick up, concerns around inflation and the government’s tight financial headroom mean mortgage rates don’t feel poised to drop meaningfully. We expect UK growth of 3.5% in 2025, which suggests the direction of travel for prices will be largely sideways.”

Jonathan Handford, managing director at national estate agent group Fine & Country:

“This slight month-on-month dip follows the stamp duty changes introduced in April and comes just ahead of the typically quieter summer period, when many families pause moving plans to focus on holidays and school breaks.

“Although economic pressures continue to impact personal finances, with inflation at 3.5% and household budgets feeling the squeeze, the Bank of England’s May rate cut to 4.25% has offered some welcome relief. While mortgage rates remain relatively high, any further easing in borrowing costs could help reignite market activity.

“Mortgage approvals fell in April as demand naturally cooled after the stamp duty tax break ended, and tighter lending criteria and deposit requirements still pose challenges for many buyers, particularly first-time purchasers. However, steady wage growth is providing some support, even if affordability remains a hurdle.

In this month’s @HalifaxBank HPI for May 2025 house prices took two steps back after taking two steps forward in April. Falling 0.4% to £296,648. This game of cat and mouse looks set to continue throughout the year, with rates determining the outcome. pic.twitter.com/1RKSpp4OAS

— Emma Fildes (@emmafildes) June 6, 2025

Matt Swannell, chief economic advisor to the EY ITEM Club:

“After a strong start to 2025, the housing market lost momentum as March’s change in stamp duty thresholds came into view and passed. Having spiked in March, housing transactions slowed sharply in April after homebuyers had rushed to complete transactions in the nick of time. This soft patch probably has a little further to go. Mortgage approvals, which lead house purchases by a couple of months, have sunk through the first four months of this year. Earlier changes to stamp duty thresholds in 2021 also led to a temporary drop-off in housing activity.

“We think that the current weakness will prove temporary and that the conditions are in place for a modest pickup in the housing market later in 2025. Further interest rate cuts and real pay gains will support demand. But with house prices remaining high, affordability challenges and ongoing economic uncertainty will temper activity.”

Northern Ireland continues to lead annual price growth in the UK

Halifax’s report also shows that house prices are rising faster in Northern Ireland, Wales and Scotland than in England.

Here’s the details:

Northern Ireland once again recorded the fastest pace of annual property price inflation, up by +8.6% over the past year. The typical home now costs £209,388, though prices remain well below the UK average.

Wales and Scotland also posted strong annual growth of +4.8% in May. Average prices now stand at £230,405 and £214,864 respectively.

Among the English regions, the North West and Yorkshire and the Humber lead the way, both showing annual house price growth of +3.7%. Average property values in these areas are now £240,823 and £213,983 respectively.

In contrast, London continues to see more subdued growth, with prices rising by just +1.2% year-onyear. However, the capital remains by far the most expensive part of the UK housing market, with the average home now priced at £542,017.

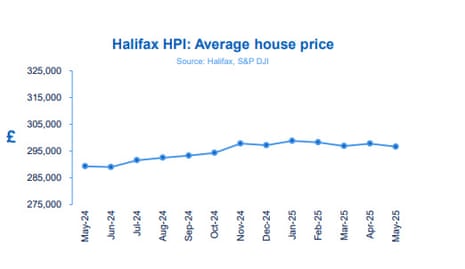

UK house prices dip in May

British house prices fell by more than expected in May, new figures from mortgage lender Halifax showed on Friday.

Halifax said house prices fell by 0.4% in May, more than reversing a 0.3% increase in April. Economists had only expected a fall of 0.1%.

According to Halifax, the average property price was £296,648 last month, down from £297,798 in April.

On an annual basis, house prices were 2.5% higher on the year – again less than expected.

Amanda Bryden, head of mortgages at Halifax, says the broader picture is that the housing market that has remained largely stable in 2025, with average prices down by just -0.2% since the start of the year.

Bryden adds:

The market appears to have absorbed the temporary surge in activity over spring, which was driven by the changes to stamp duty.

Affordability remains a challenge, with house prices still high relative to incomes. However, lower mortgage rates and steady wage growth have helped support buyer confidence.

The outlook will depend on the pace of cuts to interest rates, as well as the strength of future income growth and broader inflation trends. Despite ongoing pressure on household finances and a stilluncertain economic backdrop, the housing market has shown resilience – a story we expect to continue in the months ahead.”

Markets brace for US jobs report, after explosive Trump-Musk row

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Investors will have one eye on the US jobs market today, and the other on the spectacular blow-up between Donald Trump and Elon Musk overnight.

The latest US employment report is expected to show a slowdown in hiring across the US in May.

Economists forecast that the US non-farm payroll will have risen by around 130,000 in May, down from the 177,000 increase recorded in April, with the unemployment rate sticking at 4.2%.

A weak payrolls report could fuel fears that the US economy is slowing, as Trump’s trade wars hit activity. But it could also intensify the pressure on the US Federal Reserve to lower interest rates, something the US president has been demanding for months.

Tony Sycamore, market analyst at IG, explains:

The US unemployment rate has hovered between 4.0% and 4.2% over the past year, and a job in the unemployment rate to 4.3% or higher will heighten economic slowdown fears. The US rates market is pricing in an 85% chance of a 25bp Fed rate cut in September, with a cumulative 55bp in cuts expected by year-end.

So the markets could be volatile at 1.30pm UK time, when the non-farm payroll data lands.

Speaking of volatility… the Trump-Musk relationship exploded dramatically on Thursday, with the president and the world’s richest person slinging accusations at each other.

Shares in Tesla slumped over 14%, wiping over $150bn off the company’s value, as Trump threatened to terminate Musk’s governmental subsidies and contracts, and accused the billionaire of going “CRAZY!” over the removal of electric car subsidies.

From the other corner, Musk called for Trump’s impeachment, claimed the president appeared in the files into convicted sex offender Jeffrey Epstein, and briefly threatened to decommission SpaceX’s Dragon spacecraft.

It all added up to another bruising day for shareholders in Tesla, whose value had already been hit by the backlack against Musk’s role in the Trump Administration.

Some traders will have been betting on further falls in Tesla’s share price, as Chris Weston, head of research at Pepperstone, explains:

The selling in Tesla stock on the day has been wholly impressive with 285m shares traded on the day – the most since Jan 2023 – with a ‘sell first, ask questions later’ mentality sweeping through the shareholder base.

In the options space, over 4m put options traded hands, 4x the 20-day average.

The agenda

-

7am BST: Halifax house price index

-

9am BST: UN FAO food price index

-

10am BST: Eurozone GDP report for Q1 2025 (3rd estimate)

-

11.30am BST: Bank of Russia interest rate decision

-

1.30pm BST: US non-farm payroll report

Source link