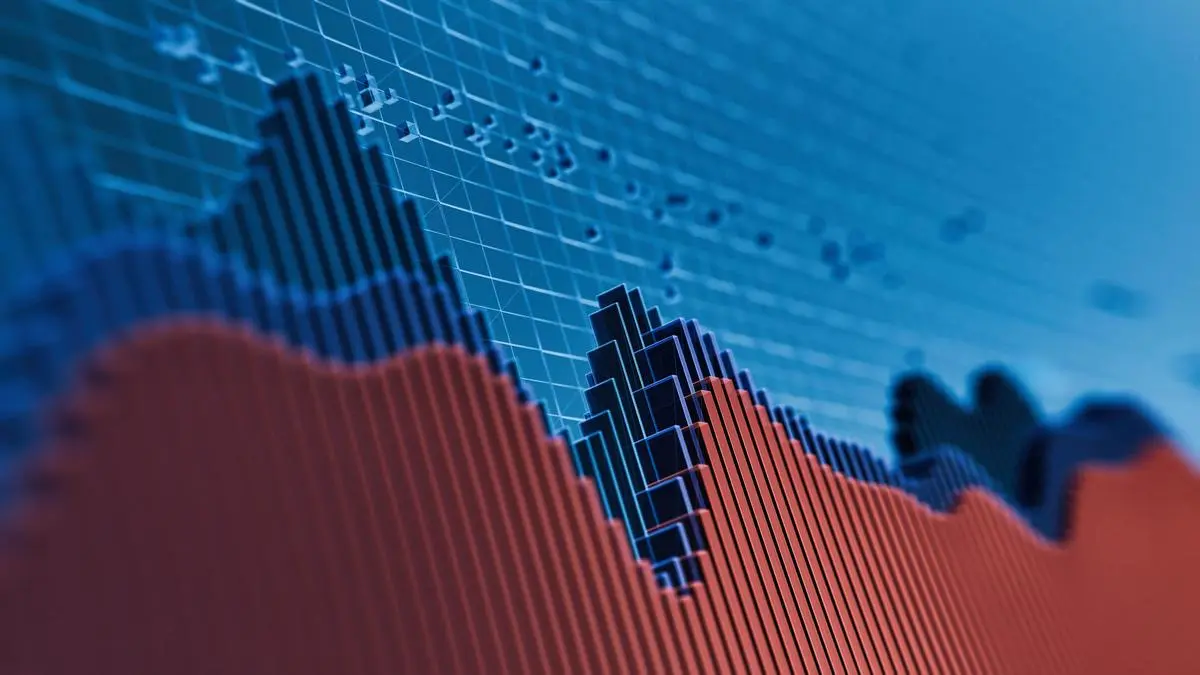

The stock of Indus Towers rebounded sharply towards the end of last week. Early in September, it bounced off a support at ₹315, which has been holding well since April last year. Also, the price is now above 50-day moving average. Overall, the chart shows that the bulls have gained good traction.

Video Credit: Businessline

Thus, even though there is a barrier ahead at ₹365, we expect the stock to breakout of the same. In the near-term, the stock can rise to ₹410. Therefore, we suggest buying it now at ₹360 and accumulate if the price dips to ₹350. Place stop-loss at ₹336. When the price hits ₹385, trail the stop-loss to ₹360. Tighten the stop-loss further to ₹385 when the stock touches ₹400. Book profits at ₹410.

(Note: The recommendations are based on technical analysis. There is a risk of loss in trading.)

Published on October 23, 2025