Taiwan Semiconductor’s growth is key to the health of the AI investment trend.

Recently, the AI debate seems to be centered on whether the computing units from Nvidia or Alphabet are the best option, with maybe Advanced Micro Devices or custom AI accelerators from Broadcom sneaking in as well. While the discourse around these companies’ different approaches is good, I think it misses a key point.

The primary fact that investors should be taking from this recent debate is that AI spending isn’t going anywhere. The AI hyperscalers have told investors to prepare for record-setting spending again in 2026, after breaking previous records in 2025.

Regardless of what computing chips are being used to fill these artificial intelligence data centers, the odds are high that those chips were made in Taiwan Semiconductor Manufacturing‘s (TSM 0.98%) facilities. And so, I think this is the most important AI stock to watch now.

Image source: Getty Images.

A key provider of chips in multiple industries

Taiwan Semiconductor is the largest chip foundry by revenue, and it makes chips for all sorts of industries. In the third quarter, 57% of revenue came from orders in the high-powered computing industry (which is mostly comprised of AI chips). That leaves a fairly sizable chunk of its business coming from other areas like smartphones (30%) and all the other industries it supports.

Taiwan Semiconductor Manufacturing

Today’s Change

(-0.98%) $-2.89

Current Price

$292.56

Key Data Points

Market Cap

$1519B

Day’s Range

$290.20 – $294.14

52wk Range

$134.25 – $311.37

Volume

2K

Avg Vol

13M

Gross Margin

57.75%

Dividend Yield

0.99%

Because TSMC is so concentrated in high-powered computing, watching to make sure its revenue growth continues will give investors a sign if the AI hyperscalers are planning on continuing their spending plans. The chips from TSMC don’t instantly go into devices from Nvidia or AMD, and there is build time for the computing devices, so it’s possible that chips being made today won’t find their way into functioning data centers until late 2026 or 2027.

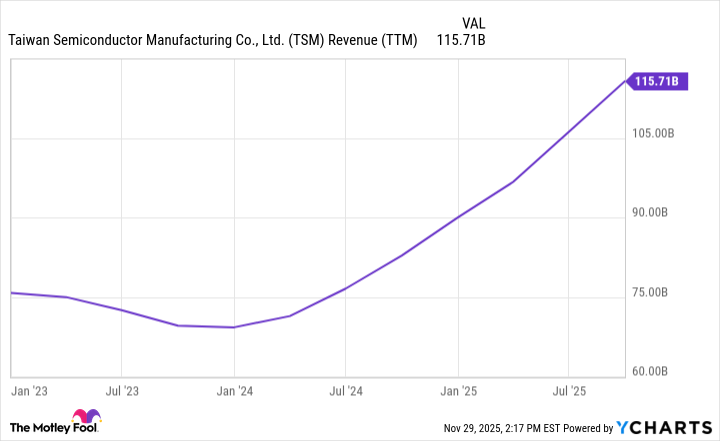

Keeping an eye on Taiwan Semiconductor’s growth will clue investors in on whether there is still a significant AI spending spree going on. With Taiwan Semiconductor’s revenue rising 41% year over year in the third quarter, I’d say the spending habits of the largest tech companies are alive and well.

TSM Revenue (TTM) data by YCharts.

Should TSMC’s revenue growth grind to a halt or move in the negative direction, it should send alarm bells through investors’ heads that something big could be coming. As a result, Taiwan Semiconductor is a key company to keep tabs on, alongside all the other computing providers.

The best way to keep tabs on a company is to own it in your portfolio, and I can think of few better stocks to own than Taiwan Semiconductor.

A rising tide lifts all ships

Determining which company will be the ultimate AI computing unit winner isn’t an easy task. There also may not be a particular company that takes over Nvidia’s dominance, either. However, chip sales for Taiwan Semiconductor will continue rising as long as there is increased appetite for AI spending, like there appears to be from big tech.

TSMC may not be the biggest winner among these AI computing stocks, but I doubt it will be the worst performer. Guaranteeing a second-best-performing stock in a group like Nvidia, AMD, Broadcom, and Alphabet is a no-brainer, making investing in Taiwan Semiconductor a smart move.

Furthermore, TSMC’s stock trades at a discount to these other four.

TSM PE Ratio (Forward) data by YCharts.

Taiwan Semiconductor may not be cheap in the grand scheme of things at 28 times forward earnings, but it’s still far cheaper than its peers. I think this makes TSMC a great buy now, as it’s slated to deliver strong growth regardless of which computing unit emerges as the top pick for 2026.

Keithen Drury has positions in Alphabet, Broadcom, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.