The stock of Ola Electric Mobility (Ola) has run up over 45 per cent over the past 30 days and about 50 per cent from its 52-week low in mid-July. The bullish sentiment reflects the optimism surrounding the stock. Good results in Q1 FY26 and its Auto business approaching free cash-flow (FCF) neutrality appear to be the primary reasons. Here, we dissect what works for the stock.

Business declines

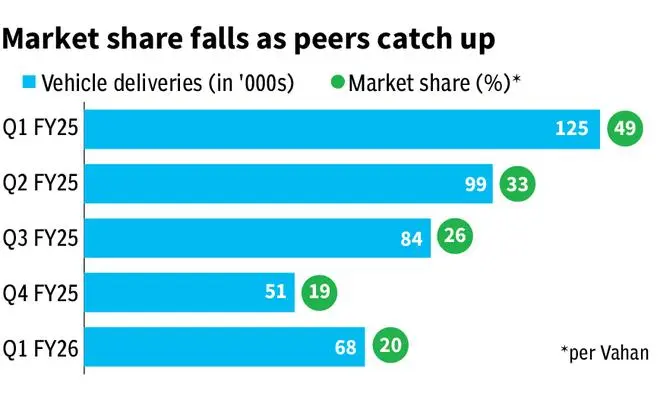

As the e-two-wheeler (e-2W) market enters consolidation after a phase of high growth by early adopters, Ola moved to a balanced profitable approach from the earlier aggressive one. This meant lower sale volumes. Revenue in Q1 FY26 fell 50 per cent to ₹828 crore. With peers launching new models/variants, intense competition, too, played its part. However, the outlook for FY26 and beyond appears better.

Margin to improve

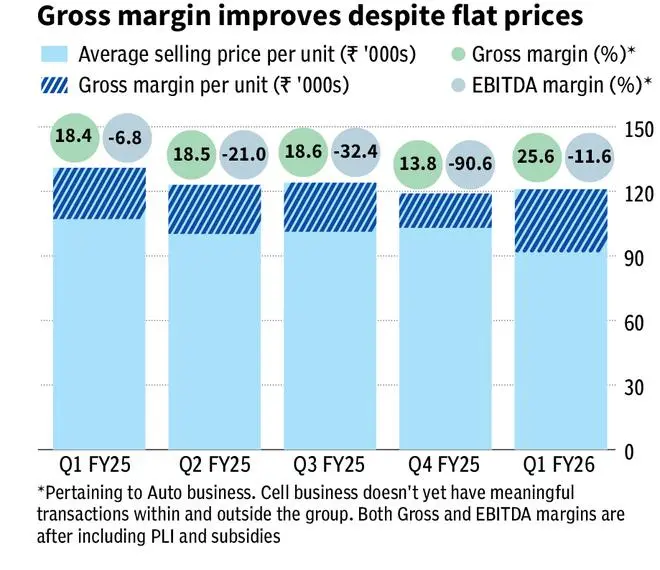

Ola has two businesses/verticals – one that manufactures and sells e-2Ws (Auto business), and the other that manufactures cells for battery packs (Cell business). Q1 FY26 saw substantial improvement in gross margin from 18 per cent in FY25. In the month of June, the Auto business even turned EBITDA-positive, per the management. As can be seen from the chart, price or realisation hasn’t played a major role in margins improving. What in fact has, is the BoM (bill of materials) cost reduction, thanks to higher share of in-house parts.

The recently-launched Gen-3 scooter is an improved product with higher content of in-house parts such as motors. This meant lower failure rates, warranty claims and higher margin. This product made 80 per cent of volume sold in Q1 FY26. Ola also has a cost reduction road-map in place, whereby operating expenses in the Auto business will be kept down to ₹100 crore per month from ₹178 crore on an average in FY25.

Further, in the recent quarter, PLI benefits and subsidies made just 2.5 per cent of Auto revenue, versus an average of 10 per cent in FY25. The Gen-3 scooter has been certified for PLI benefit recently and going ahead, PLI benefit will flow through to margins. Given this, the management is looking at an FY26 exit gross margin of 35-40 per cent.

Similarly, the recently-launched e-bike ‘Roadster’ is also to be likely approved for PLI in the coming quarters. Margin-wise, the bike is expected to earn as much as the Gen 3 scooter. Distribution, too, will be ramped up to all Ola stores from September-end; it is currently available in 200-odd stores.

Cell business outlook

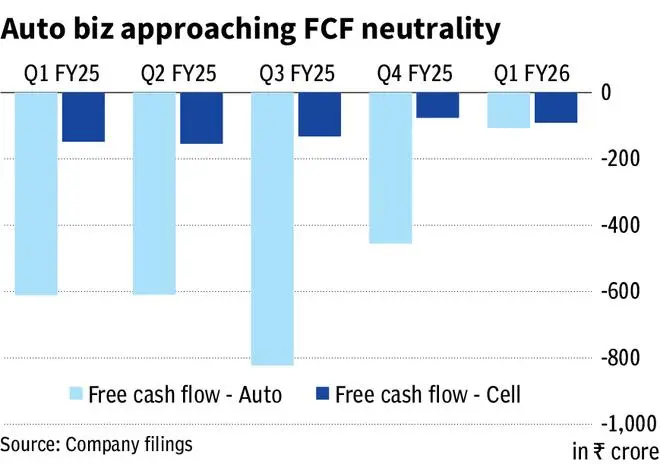

Ola’s cell Gigafactory is budgeted to cost about ₹2,800 crore. This is to build a capacity of 5 GWh, which roughly means about 12 lakh vehicles can be equipped with a battery pack of 4 kWh. For context, about 11.5 lakh e-2Ws were sold in the country in FY25. The plant already has a capacity of 1.4 GWh and Ola has spent about ₹1,500 crore on it. The capex projection for FY26, for building the rest of the capacity, is about ₹1,000 crore; the balance would be made in the next year. Hence, the Cell business won’t become FCF neutral in the near term.

However, the Auto business — having seen enough capacity buildouts — will now move towards FCF neutrality. The management expects it to become FCF positive by FY26-end. The in-house cells will be used in a couple of models shipping this quarter, while the rest continue to be shipped with imported cells. This is another margin lever.

Though the manufacturing of cells is a capital-intensive business, Ola assesses that benefits such as a reliable supply, arbitrage with imported cells from import duty and cost advantage from owning the technology outweigh the costs. Even when operating at 1.4-GWh capacity, Ola hopes it would save money at the gross margin level. With the surplus capacity, the company looks to tap opportunities in the BESS (battery energy storage system) space and even supply to other OEMs.

The cells are also eligible for PLI. The conditions require Ola to build capacity of up to 20 GWh by FY27. However, since the management deems the current capacity adequate for the next 3-5 years, it has been factoring a maximum penalty of ₹100 crore per quarter in the P&L.

Positives priced in

Though there are these positives, execution is not a given. Warranty cost (at 12 per cent of FY25 revenue) is to be closely monitored. In Q4 FY25, the company made a one-time additional provision of ₹250 crore (5.5 per cent of FY25 revenue) towards warranty claims from customers of the older Gen-1 and -2 scooters. Now, 70 per cent of Gen-1 scooters have passed the warranty period and the rest is expected to pass in the next 12 months. The recently-launched Gen-3 scooter doesn’t have enough vintage to prove it will save on warranty.

Competition is something that Ola cannot simply ignore. Legacy OEMs such as Bajaj and TVS are well on track towards profitability in their electric portfolios. Hero, with its Vida offerings, has nearly doubled its FY25 market share to about 9 per cent now. Peer Ather is working on a new versatile, cost-effective platform. While the intent is to keep operating expenses (38 per cent of revenue in Q1 FY26) in check, tackling competition could mean higher promotional expenditure. Also, with new launches in the future, R&D costs could be buoyant.

Despite boasting an in-house cell facility, Ola will still be vulnerable to volatility in input prices. Lithium Carbonate prices have rallied over 10 per cent in recent weeks. Considering the above factors, the stock with its current valuation of 5.7 times EV/revenue appears priced to perfection, leaving no margin for error. Hence, investors can wait and watch until there is better clarity on the company’s execution.

Published on September 6, 2025